DSCC says that OLED production will grow 94% in the Q2 2021, fueled by strong demand for OLED in smartphones, TVs and other devices - coupled with a recovery from the pandemic. Growth in OLED input area for small & medium displays is expected to grow 68%, while grow in OLED TV input area will grow by 134% over last year.

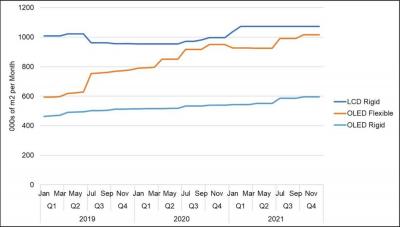

The chart above shows the total OLED (and mobile LCD) industry capacity. As you can see, flexible OLED capacity is growing - mainly from expansions by CSoT, Tianma and Visionox. There's also growth in rigid OLED capacity - from Everdisplay and JOLED.

There's a consistent pattern of slower production for flexible OLED production in the first half of the year, and much higher production in the second half. DSCC largely attributes this to seasonal demand from Apple and other smartphone makers.

DSCC sees rigid OLED is rebounding in 2021 as Samsung has gotten more aggressive on rigid OLED panel pricing. Rigid OLED input area was up 41% Y/Y in Q1 and is expected to be up 61% Y/Y in Q2.

DSCC says that Samsung’s A3 fab, by far the largest flexible OLED, ran at 94% utilization in the second half of 2020, and DSCC expects it to run even higher at 97% in the second half of 2021. LG Display’s E6 fab also benefits from the same seasonality, and DSCC expects it to run at 89% in the second half. BOE continues to struggle with low utilization as it Huawei reduced its panel demand drastically. BOE’s B7 line in Chengdu had only 35% utilization rate in Q1. BOE will remain in low utilization rates for the rest of the year, according to DSCC.