BOE Display, founded in 1993 in Beijing China, is one of the world's leading display maker, producing both LCDs and OLEDs. BOE also produces LCD backlighting units and solar panels.

BOE Display, founded in 1993 in Beijing China, is one of the world's leading display maker, producing both LCDs and OLEDs. BOE also produces LCD backlighting units and solar panels.

BOE has been producing small glass-based OLEDs for some time, but the company's focus is currently in flexible and foldable OLEDs. In October 2017 BOE started to produce flexible OLED displays at its first flexible OLED line, the Chengdu B7 6-Gen fab. The annual capacity of the B7 line, when complete and at 100% yields, will be 45,000 monthly 6-Gen substrates, or about 90 million smartphone OLEDs.

In addition to the B7 fab in Chengdu, in October 2016 BOE announced another 6-Gen OLED fab, in Mianyang, with a similar capacity. In March 2018, BOE announced plans for a third 6-Gen OLED fab, this one in Chongqing. In December 2018, BOE announced plans for its fourth 6-Gen AMOLED line in Fuzhou. Towards the end of 2023, BOE announced plans for a 8.6-Gen flexible LTPO AMOLED line in Chengdu. BOE is also building an OLED Microdisplay fab in collaboration with OLiGHTEK.

No.10 Jiuxianqiao RD

Beijing

100015

China

Reports suggest quality issues at BOE may shift iPhone OLED orders to Samsung Display and LG Display

Sources in Korea suggest that BOE struggles with supplying AMOLED panels to Apple's iPhone, and Apple may switch some of its orders to LG Display and Samsung Display.

BOE is supplying LTPS AMOLED displays to Apple's iPhone 14, 15 and 16 devices, but the company faces quality issues and Apple has rejected many of its displays. It is estimated that it will take at least 6 weeks for BOE to fix the OLED quality problems, and meanwhile since the beginning of 2024 it managed to ship only about 7-8 million panels to Apple - from orders of around 40 million units.

DSCC: the OLED materials market grew 22% in 2024, Chinese material makers enjoy a sharp increase in demand

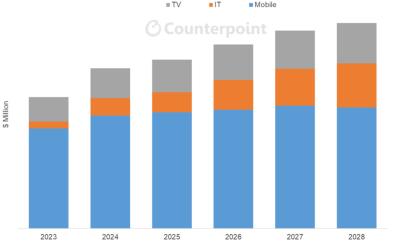

DSCC (now part of Counterpoint) says that OLED evaporation material sales will grow 22% in 2024, and will continue to grow at a 6.4% CAGR from 2024 to 2028. Most of the growth will come from IT display panels, for laptops, monitors and tablets.

Interestingly, DSCC estimates that Chinese material developers enjoyed a 58% increase in sales in 2024 to $252 million. The primary reasons for this sharp increase in demand is increased utilization at Chinese AMOLED fabs, increased orders from local companies in China over sourcing these materials from the rest of the world, and new range of materials introduced by materials makers (as Chinese material developers move from intermediates production to emitters and dopants).

UBI Research: the OLED emitter market reaches a new high in Q3 2024

UBI Research estimates that the volume of OLED emitting materials purchased in Q3 2024 reached 32.7 tons, which is the highest ever, with the previous record in 2021. UBI expects 2024 as a whole to be the record year in OLED emitter material shipments.

In terms of customers, SDC holds the largest share with 41.4% of the total market, followed by LGD (20.5%), BOE (11.6%) and Visionox (8.3%). In terms of architecture, 83.7% of all emitter materials went into RGB OLEDs, 11.3% into WOLED (LG's WRGB) panels and 2.8% into QD-OLED panels.

The US ITC decides that BOE infringes upon Samsung's OLED patent, does not ban panel imports yet

Samsung Display and BOE are fighting a legal battle in the US, as Samsung wishes to halt the import of BOE OLED displays (such as the ones used by Apple in the upcoming iPhone 4 SE smartphone, according to reports) saying that BOE infringes upon Samsung's patents. BOE, meanwhile, together with other OLED makers in China, answered with a motion of their own, to dismiss an SDC AMOLED patent.

The US International Trade Commission (ITC) has now ruled that BOE indeed infringed upon Samsung's OLED patents. However the ITC rejected Samsung's request to ban the import of BOE's displays into the US. Samsung asked to re-examine the decision and the final verdict on issue will be given on March 2025.

Samsung Electronics to order smartphones OLED panels from Tianma as SDC's cannot produce enough to satisfy demand

Yesterday we reported that Samsung Display aims to increase its small-sized and mid-sized AMOLED panels production in 2025 by 10.25% to 475 million panels. It was understood that Samsung hopes to sell more foldable OLED panels and tablet OLED panels.

Today we hear another report that Samsung Display's capacity is totally booked, and the company cannot supply enough smartphone OLED to Samsung Electronics. It is said that Samsung Electronics will order some AMOLED smartphone displays from Tianma to be used in its low-end ranges, the Galaxy M and Galaxy F smartphones.

BOE may face delays in its 8.6-Gen IT flexible OLED line, as one of its suppliers faces financial problems

Towards the end of 2023, BOE officially announced its plans for a 8.6-Gen flexible LTPO AMOLED line in Chengdu. The agreement with Chengdu's local government was signed in early 2024, and in April BOE announced it is starting to construct the new fab. A few weeks ago BOE said it finished the construction of the main outer structure in this project, and that the company is on track to finish the fab by May 2026, with mass production expected by October 2026 - and full production in 2029.

Today there is a report from Korea that one of BOE's suppliers, Hansong Neotech, faces financial problems (and its stock has been delisted from the Korean stock exchange). The company may not have enough money to coninute its operations and build the BOE systems.

Huawei expected to order 61 million smartphones OLED panels this year, up 81% from 2023

According to reports, Huawei is enjoying high demand for its AMOLED smartphones in 2024, and it is expected to order 61 million AMOLED panels by the end of the year - up 81% over 2023 (33.7 million).

Huawei suffered from US sanctions in 2019 that drastically decreased its smartphone sales, but in 2023 it has returned to the smartphone market in force, and now it is enjoying very high demand for its smartphones.

BOE develops new under-the-OLED camera technology, to supply it to ZTE's Nubia and Red Magic flagship smartphones

BOE technology announced that it developed a new under-the-display OLED camera solution, to enable full-screen smartphone OLED displays with higher quality cameras than before. The company held a ceremony together with ZTE's Nubia and Red Magic smartphone brands, saying that it will supply the display and camera solutions to flagship smartphones from these two brands soon, the Nubia Z70 Ultra and the Red Magic 10 Pro.

BOE says that the new AMOLED displays adopt several innovative technologies, such as SIP ultra-narrow bezels, COP packaging - and the new under-the-OLED camera. The new technology achieves a full 430 PPI resolution for the OLED display including in the camera area, and the smartphones will offer a 95.3% screen-to-body ratio (as there's no notch or punch-hole).

Apple reportedly established four new display research labs in China, aiming to expand its OLED supply chain in China

According to industry reports, Apple recently established four display research labs in China, in Beijing, Shenzhen, Suzhou, and Shanghai.

Apple has reportedly formed an alliance with China's leading OLED makers, as the company gets ready to deploy OLED panels in its laptops and tablets. Apple is interested in diversifying its supply chain and not rely exclusively on Samsung Display and LG Display for its smartphone and IT AMOLED panels. The main goal of the new research labs is to test OLED panels produced by Chinese display makers, and evaluate and compare them to LG's and Samsung's OLEDs.

BOE and Omniply to co-develop materials and processes for flexible display manufacturing

BOE Technology Group and Canada-based Omniply Technologies announced a co-development agreement, with an aim to develop new materials and process technologies for display manufacturing.

It turns out that the two companies have been working together for almost 2 years, hoping to bring Omniply's technology into BOE's next-generation flexible OLED fab. BOE hopes that Omniply's technology may enable lower cost production of OLED displays, and the production of more eco-friendly displays. It also has the potential to be used in flexible sensors and microLED products in the future.

Pagination

- Page 1

- Next page