Tianma Micro-Electronics is a China-based display producer that was established in 1983. TianMa has been active with OLED R&D since 2010.

Tianma Micro-Electronics is a China-based display producer that was established in 1983. TianMa has been active with OLED R&D since 2010.

Tianma is currently producing AMOLED displays at its 6-Gen LTPS AMOLED fab in Wuhan, China - which was the first 6-Gen AMOLED line in China to enter production. The company produces mainly smartphone and wearable AMOLED panels. Tianma has a global AMOLED market share of about 8%.

Here are some of Tianma's latest OLED (and microLED) displays, shown at Displayweek 2024.

Ma Long 64 1A

Nanshan Qu

Shenzhen Shi

Guangdong Sheng

China

Tianma and Corning show a dual-screen multi-curved color-matched automotive OLED display

At CES 2025, Tianma unveiled a new display prototype that it has developed in collaboration with Corning. This is an automotive OLED display that is made from two 13-inch AMOLED panels. The company says the new display offers "unparalleled visual clarity in automotive applications".

The new OLED display features a unique multi-curvature design, with a left curvature radius of R800mm for optimal driver focus, a middle curvature radius of R1140mm, and a right curvature radius of R2160mm to accommodate the passenger. The system seamlessly bonds two color-matched 13" OLED displays to the multi-curve cover glass made possible with Corning ColdForm technology.

Will Tianma exclusively supply OLED displays for Apple's next-generation HomePod device?

There is an interesting (but unverified) report out of Korea that Apple has chosen Tianma to be its exclusive OLED display supplier for a next-generation HomePod smart speaker device, the first one with a display. The OLED HomePod will be released in 2025.

Rumors about a HomePod with a display started surfacing last year, then suggesting that the display will be a 7-inch LCD, indeed supplied by Tianma. But these new rumors suggests that Apple has opted for a higher-quality LTPS AMOLED display, sized 6.7-inch.

Samsung Electronics to order smartphones OLED panels from Tianma as SDC's cannot produce enough to satisfy demand

Yesterday we reported that Samsung Display aims to increase its small-sized and mid-sized AMOLED panels production in 2025 by 10.25% to 475 million panels. It was understood that Samsung hopes to sell more foldable OLED panels and tablet OLED panels.

Today we hear another report that Samsung Display's capacity is totally booked, and the company cannot supply enough smartphone OLED to Samsung Electronics. It is said that Samsung Electronics will order some AMOLED smartphone displays from Tianma to be used in its low-end ranges, the Galaxy M and Galaxy F smartphones.

Apple reportedly established four new display research labs in China, aiming to expand its OLED supply chain in China

According to industry reports, Apple recently established four display research labs in China, in Beijing, Shenzhen, Suzhou, and Shanghai.

Apple has reportedly formed an alliance with China's leading OLED makers, as the company gets ready to deploy OLED panels in its laptops and tablets. Apple is interested in diversifying its supply chain and not rely exclusively on Samsung Display and LG Display for its smartphone and IT AMOLED panels. The main goal of the new research labs is to test OLED panels produced by Chinese display makers, and evaluate and compare them to LG's and Samsung's OLEDs.

The US is looking into backlisting both BOE and Tianma as it fears that China is taking over the display industry, we look into the implications

The Chairman of the US House Select Committee on the Chinese Communist Party, John Moolenaar, sent a letter to the US Secretary of Defense, saying that the US should place both BOE and Tianna on the DoD 1260H blacklist as Chinese military companies.

In his letter, Mr. Moolenaar says that by using government support, the Chinese has taken over the display industry, and are already leading both the LCD and OLED markets (which is indeed mostly true). As these two companies have close ties to the Chinese government and military, this, according to the letter, poses a big risk to US and its allies.

BOE, Tianma, TCL CSoT, EDO and Visionox all post improved quarterly earnings

Recently, BOE, Tianma, TCL, EDO and Visionox all posted their financial results for Q2 2024, and all were rather positive. Samsung Display and LG Display also posted increased earnings for the quarter.

So we start with BOE, that posted revenues of 93.4 billion yuan (13.17 billion USD) for the first half of 2024, an increase of 16.47% over H1 2023. Its net profit increased 210% compared to last year (2.285 billion Yuan, or $320 million USD). BOE enjoyed increased LCD sales and optimized production, and also noted high demand for high-end foldable OLED displays.

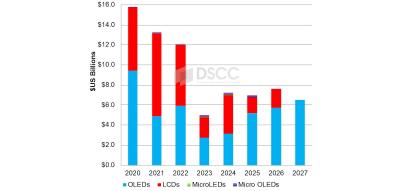

DSCC details the display industry's capital spending on equipment from 2020 to 2027

DSCC says that display makers are increasing their OLED CapEx investment as demand for OLED displays is on the rise. DSCC has raised its forecast for OLED spending by 14% compared to their previous update, while they retain their previous forecast for LCD, OLED microdisplay and microLED display equipment spending.

Between 2020 and 2027, OLED display makers will invest $44 billion in new production equipment. The spending on OLED equipment will keep growing year after year from 2023 to 2027, reaching $6.5 billion in 2027, as OLED penetration in the smartphone, tablet and laptop market is increasing, and fab utilization is increasing too, encouraging display makers to add capacity.

Tianma shows its latest OLEDs and MicroLEDs at Displayweek 2024

China-based Tianma had an impressive booth at Displayweek 2024, showing numerous OLED and microLED displays and prototypes.

For the automotive market, Tianma showed three new display prototypes. First up is a 13" slidable OLED, with an embedded touch panel, aimed towards car dashboards or center controls.

China's small-to-medium OLED production surpasses Korea's for the first time

According to Sino Research, in the first quarter of 2024, small-to-medium AMOLED production in China surpassed the production in Korea, by shipments, for the first time. China's market share was 53.9%, an increase from 44.9% in Q4 2023.

The leading producer is still Samsung Display, with a 41% market share (down from 53.3% last year). BOE has a market share of 17%, Visionox 12%, CSoT 10%, Tianma 9% and LGD 6%. The mean reason for the rise in China production and a decline in Korea's is lower shipments to Apple and an increase in the adoption of OLEDs in Chinese smartphones.

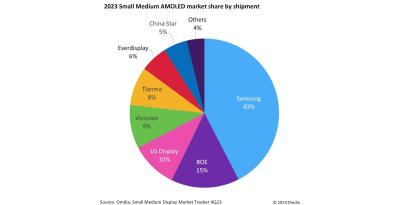

Omdia: Samsung leads the small and medium AMOLED market with a 43% market share in 2023

Omdia released its small and medium (9-inch and lower) AMOLED market share information for 2023, saying that even though Samsung's market share was lower than 50% for the first time, it stills leads the market by a large margin, with a 43% market share.

Samsung is followed by BOE (15%), LG Display (10%), Visionox (9%) and Tianma (8%). The total market reached 842 million units, a growth of 11% over 2022. Omdia says that the China-based OLED makers have been expanding their capacity and improving the quality of the produced panels, and are securing orders from domestic smartphone brands.

Pagination

- Page 1

- Next page