TCL China Star Optoelectronics Technology (CSOT, also called Shenzhen Huaxing Photoelectric Technology) is a China based display producer (owned by TCL, Century Science & Technology Investment and Samsung Display). The company is producing both LCDs and OLED displays.

TCL China Star Optoelectronics Technology (CSOT, also called Shenzhen Huaxing Photoelectric Technology) is a China based display producer (owned by TCL, Century Science & Technology Investment and Samsung Display). The company is producing both LCDs and OLED displays.

CSoT started developing OLED technologies back in 2012. In 2013 it was reported that CSOT will invest over $4 billion to build a 8.5-Gen Oxide-TFT LCD+OLED TV fab, but that did not materialize. In 2017 CSoT started to construct a 6-Gen LTPS flexible AMOLED production line in Wuhan, China, in a $5 billion investment. CSoT is now producing mobile AMOLED displays at that fab, and is developing high-end technologies, including LTPO, microlens arrays and polarizer-free OLEDs. In May 2024 it has announced a $8.7 billion investment towards a 8.6-Gen IT AMOLED line.

CSoT is very active with inkjet printing technologies, and has been developing the technology for many years. TCL CSoT aims to start mass production of IT AMOLED products by using inkjet printing in a low-volume fab by the end of 2024. The company demonstrated impressive printed OLED prototypes over the years.

No.5 FuHong Road

FuTian

ShenZhen

China

TCL CSOT Showcases Cutting-edge Professional Display Solutions at ISE 2025

TCL CSOT, a global leader in display technology, presented its latest professional display innovations at Integrated Systems Europe (ISE) 2025 on February 4-7 in Barcelona. The company's comprehensive display solutions demonstrate TCL CSOT's technological prowess and commitment to advancing the professional display industry through continuous innovation.

TCL CSOT presents its cutting-edge 5.5” Industry's Highest Tr Real-4K Projector, featuring an impressive Real-4K resolution (3840 * 2160), 800 PPI, and an industry-leading 6.2% Tr value. This innovative projector represents a significant breakthrough in Real-4k 1LCD Projector screen technology, offering unprecedented clarity and performance in a compact form factor.

TCL CSOT Showcases Advanced Commercial Display Solutions at ISE 2025

TCL CSOT, a leading innovator in display technology, presents its comprehensive commercial display portfolio at Integrated Systems Europe (ISE) 2025, which took place on February 4-7 in Barcelona. The lineup demonstrated TCL CSOT's technological expertise in meeting the diverse needs of commercial applications through continuous innovation.

Leading the professional display lineup is TCL CSOT's outdoor high-brightness series, featuring displays engineered for exceptional outdoor visibility. The 55” FHD Outdoor High-Brightness Display delivers an impressive 4000 nit brightness, while the 65” UHD Outdoor High-Brightness Display and 75” UHD Outdoor High-Brightness Display offer 2500 nit brightness, making them ideal for outdoor digital signage applications. All models feature advanced DLED backlight technology and support 24/7 operation, with high refresh rates of 120Hz for smooth content display.

TCL starts mass producing inkjet printed OLEDs, with a 21.6" 4K OLED monitor panel as the first product

TCL CSoT announced several times in the past that it plans to start producing OLED display using an inkjet printing process by the end of 2024, and yesterday it officially announced it has started mass producing printed OLED displays at its 5.5-Gen production line.

The company brands these displays as APEX OLED displays. In fact it seems as if all of TCL displays (OLEDs and LCDs both) will be branded as APEX OLEDs, with the slogan PACE to APEX.

Huawei expected to order 61 million smartphones OLED panels this year, up 81% from 2023

According to reports, Huawei is enjoying high demand for its AMOLED smartphones in 2024, and it is expected to order 61 million AMOLED panels by the end of the year - up 81% over 2023 (33.7 million).

Huawei suffered from US sanctions in 2019 that drastically decreased its smartphone sales, but in 2023 it has returned to the smartphone market in force, and now it is enjoying very high demand for its smartphones.

Apple reportedly established four new display research labs in China, aiming to expand its OLED supply chain in China

According to industry reports, Apple recently established four display research labs in China, in Beijing, Shenzhen, Suzhou, and Shanghai.

Apple has reportedly formed an alliance with China's leading OLED makers, as the company gets ready to deploy OLED panels in its laptops and tablets. Apple is interested in diversifying its supply chain and not rely exclusively on Samsung Display and LG Display for its smartphone and IT AMOLED panels. The main goal of the new research labs is to test OLED panels produced by Chinese display makers, and evaluate and compare them to LG's and Samsung's OLEDs.

The Elec: TCL CSoT's first inkjet printed panel will be a 21.6" 4K monitor panel, targeting medical applications

TCL CSoT has announced several times in the past that it plans to start producing OLED display using an inkjet printing process by the end of 2024, and a new report from Korea updates the latest status from the company.

TCL CSoT originally said it will produce OLED TV panels, but later updated its plans to produce IT displays. According to the Elec, the company has decided that its first panel to be produced is a 21.6" monitor displays for medical devices. The company has unveiled this panel in SID 2024 - it has a 4K resolution and a peak brightness of 350 nits.

OLED TVs - is there a path towards increased production capacity?

OLED TVs offer excellent image quality, outperforming LCDs with superb contrast, excellent and vivid color reproduction and fast refresh rates. In addition, OLEDs enable thin and efficient TVs. OLED TV production has been increasing up until a year ago, reaching a potential capacity of around 10 million units. This is impressive, but considering the entire global TV market that amounts to around 250 million units, OLEDs represent only around 2.5% of the total market (it is important to note that OLEDs tend to be produced in large sizes and carry a much higher average selling price compared to LCDs).

But OLED TV production capacity growth has declined in recent years. In this article we will shortly detail the history of OLED TV production, and look at potential paths towards increased penetration in the future. More details and into the future of OLED technologies and OLED TVs is included in the OLED Toolbox.

A bit of history: in 2013, both Samsung and LGD started producing OLED TV panels. Samsung chose the straightforward RGB side-by-side architecture, in which there are three sub-pixels, with red, green and blue OLED emitters. LG chose its own WRGB (or WOLED) architecture (the IP was acquired from Kodak in 2009) which uses four white OLED subpixels (made from yellow and blue OLED subpixels). Both companies released 55" FHD OLED TVs, priced at over $10,000 per unit. It soon became clear that Samsung's approach was not scalable, while LGD managed to enter mass production quickly and reduce prices dramatically within a few years to compete with the dominant LCD TV technology.

The US is looking into backlisting both BOE and Tianma as it fears that China is taking over the display industry, we look into the implications

The Chairman of the US House Select Committee on the Chinese Communist Party, John Moolenaar, sent a letter to the US Secretary of Defense, saying that the US should place both BOE and Tianna on the DoD 1260H blacklist as Chinese military companies.

In his letter, Mr. Moolenaar says that by using government support, the Chinese has taken over the display industry, and are already leading both the LCD and OLED markets (which is indeed mostly true). As these two companies have close ties to the Chinese government and military, this, according to the letter, poses a big risk to US and its allies.

LG Display officially sells its last two LCD fab in China to TCL CSoT

As we reported last month, TCL CSoT officially announced that it has agreed to buy LG Display's last LCD production line in Guangzhou, China, for $1.5 billion (10.8 billion Yuan).

TCL CSoT will acquire 80% of LG Display's 8.5-Gen LCD production line, and 100% of its LCD module line in Guangzhou. The two companies plan to complete the deal by the end of March 2025. LG's LCD production line has a capacity to produce 180,000 TV panels per month, most of these sized 55" and up (about 6% of the total LCD panel market), and had a net profit of $85 million last year over $900 million in revenues. The module factory can produce 2.3 million units per month. The two factories serve customers such as Samsung Electronics, LG Electronics, Skyworth, and more.

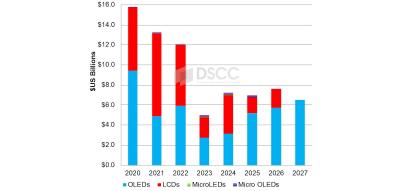

DSCC details the display industry's capital spending on equipment from 2020 to 2027

DSCC says that display makers are increasing their OLED CapEx investment as demand for OLED displays is on the rise. DSCC has raised its forecast for OLED spending by 14% compared to their previous update, while they retain their previous forecast for LCD, OLED microdisplay and microLED display equipment spending.

Between 2020 and 2027, OLED display makers will invest $44 billion in new production equipment. The spending on OLED equipment will keep growing year after year from 2023 to 2027, reaching $6.5 billion in 2027, as OLED penetration in the smartphone, tablet and laptop market is increasing, and fab utilization is increasing too, encouraging display makers to add capacity.

Pagination

- Page 1

- Next page