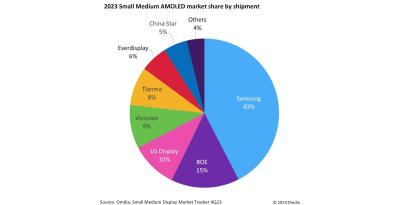

Omdia: Samsung leads the small and medium AMOLED market with a 43% market share in 2023

Omdia released its small and medium (9-inch and lower) AMOLED market share information for 2023, saying that even though Samsung's market share was lower than 50% for the first time, it stills leads the market by a large margin, with a 43% market share.

Samsung is followed by BOE (15%), LG Display (10%), Visionox (9%) and Tianma (8%). The total market reached 842 million units, a growth of 11% over 2022. Omdia says that the China-based OLED makers have been expanding their capacity and improving the quality of the produced panels, and are securing orders from domestic smartphone brands.

Reports suggest BOE and perhaps Tianma to supply all the AMOLEDs for Apple's iPhone SE 4

A report from China suggests that Samsung will not produce any AMOLEDs for the upcoming Apple iPhone SE 4, as the Korean maker asked for around $30 per unit (6.1-inch) which was too high for Apple. Apple apparently wanted to pay only $25, and it is estimated that BOE will supply most of the units, with some orders perhaps going to Tianma.

According to reports, Samsung estimated that it will not be able to make a profit in this project and decided to stop the negotiations when Apple insisted on a low price.

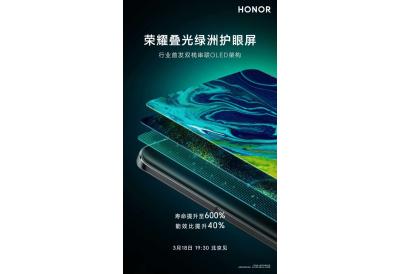

BOE commercializes tandem smartphone AMOLED displays to improve lifetime and efficiency

According to reports, BOE has commercialized a new tandem OLED architecture, that enabled an improvement of 40% in power consumption and a 600% increase in display lifetime.

As you can see from the teaser poster above, Chinese smartphone maker Honor will release the first phone to adopt the new panel, the Honor Magic 6 Ultimate, next week on March 18th.

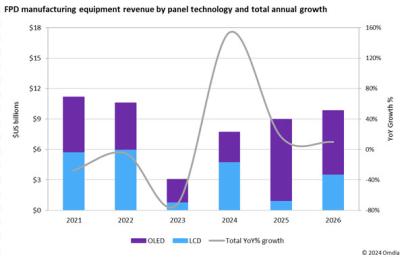

Omdia sees a rebound in the display production equipment market

Market research firm Omdia says that display production equipment sales will rebound in 2024 and reach $7.7 billion (154% over 2023), and will grow slowly in the near future, mainly driven by 8.6-Gen OLED production lines (used to make IT displays).

Omdia says that the new 8.6-Gen OLED fab require novel technologies, which results in high equipment costs. In 2024, 32% of all spending ($2.4 billion) will be for Samsung's A6 line, a large investment for a 15,000 monthly subtrates fab. BOE's investment in its upcoming B16 flexible 8.6-Gen line will be even higher - by 18% due to the backplane choice (LTPO over Samsung's oxide-TFT A6).

BOE reports a 70% drop in profits in 2023, as demand for displays remains low

BOE Group says that profits in 2023 dropped almost 70% compared to 2023, as demand for displays is low. BOE says that its profit in 2023 will be in the range of 2.3 to 2.5 billion yuan (around $324 to $350 million USD). Including some nonrecurring items, the company expects to report a net loss of $77 - $100 million USD in 2023 (that's around 70% lower than the loss in 2022).

BOE says that its LCD business was more profitable in 2023 - which likely means that its OLED business is still incurring losses. BOE updates that it shipped almost 120 million flexible AMOLED displays in 2023 (in October it said it sold over 100 million).

The OLED Marketplace now lists LG Display's and BOE's transparent OLED displays

The OLED Marketplace is now listing LGD's range of transparent OLED displays, currently in 30-inch (HD resolution) and 55-inch (FHD resolution). LG's 77" transparent OLED, which will soon enter production, will also be available soon. The displays are available with an optional touch display, can be bought as a bare panel, or a monitor, or a complete 'kiosk' solution.

In addition to LGD's displays, we also list BOE's 55" FHD transparent OLED displays. BOE's panel offers similar specifications to LGD's panels, but are lower in cost. BOE is also producing 49-inch transparent OLEDs, and these will hopefully be available at the OLED marketplace soon.

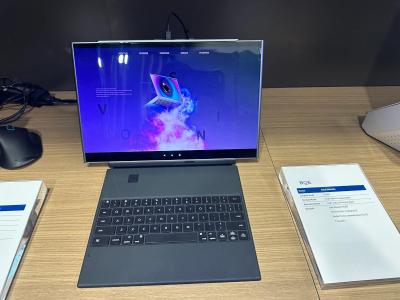

BOE shows a dual-slidable laptop AMOLED display

BOE signs the official contract with Chengdu's local government to build its 8.5-Gen IT AMOLED line

BOE has been planning a 8.5-Gen flexible IT AMOLED Line for a couple of years, and in November 2023, following some delays, the company officially announced its plans for the new fab. Now we hear from China that the Chengdu local government, together with Chengdu's Hi-Tech Industrial Development Zone, have signed the contact with BOE to build the new plant.

The total investment in the fab is expected to reach 63 billion Yuan (over $8.7 billion USD). The fab will have a capacity of 32,000 monthly substrates (2290x2620 mm), and is expected to begin production by Q4 2026 (total construction time will be 34 months, according to the plan).

Reports from China suggest that Apple cancelled its BOE iPhone AMOLED orders due to quality issues

Last month we reported that BOE finally got accepted into Apple's latest-generation iPhone supply chain, and the company will supply 2 million AMOLED displays for iPhone 15 devices in 2023 (that's about 3% of Apple's total iPhone orders). This news came after many years when BOE failed to meet Apple's quality tests.

A new report from China now suggest that BOE's AMOLED displays have been found to still suffer from issues - specifically light leakage around the selfie-camera and sensor 'island'. Eventually Apple decided to cancel its orders from BOE this year, at least until the China-based display maker can fix the issue.

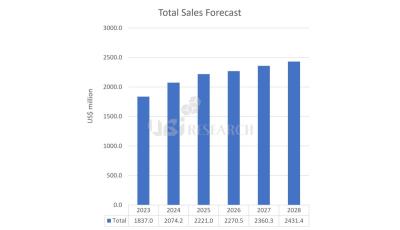

UBI Research: OLED material sales to reach $2.43 billion in 2028

UBI Research updated its forecast for the OLED material industry, saying that total sales of OLED materials will grow from $1.84 billion in 2023 to $2.43 billion in 2028, a growth of 5.8% CAGR.

UBI says that in 2028, SDC will purchase OLED emitters in $810 million, LGD in $550 million and BOE in $440 million.

Pagination

- Previous page

- Page 4

- Next page