A Conversation with Kateeva CEO, Bin Liu

Display Week 2024 was a busy and exciting event for Kateeva. CEO Bin Liu was on site at our US HQ in Newark, California. At the SID show in San Jose, he met with customers to get a flavor of the latest display technology innovations that will inform our product roadmap.

Bin Liu, CEO, Kateeva

One of the highlights at SID week was a celebration of Kateeva’s CTO Emeritus, Steve Van Slyke. Steve and Ching Wan Tang received the Karl Ferdinand Braun Award for their co-invention of the OLED device. The accolade is the highest honor conferred by the Society for Information Display. It recognizes “outstanding technical achievement in, or contribution to, the display industry”.

Since becoming CEO in late 2022, Bin and the leadership team have implemented a new vision for Kateeva. He will share the details in a keynote talk at Display Innovation China in Shanghai, this week (July 3-5).

Apple reportedly reaches out to Samsung and LG regarding the supply of OLED microdisplays

According to a report from Korea, Apple has sent an RFI for both Samsung Display and LG Display, seeking more information about the two companies capabilities regarding the production of OLED microdisplays. It is speculated that Apple is seeking to change its OLED supplier in a future, lower-cost VR headset.

Apple specifically mentions a white OLED with color filters architectures (i.e. not a direct-patterned device), a panel size of 2 to 2.1 inch and a display density of around 1,700 PPI (which is rather low, Sony's 4K microdisplays used in the Apple Vision Pro for example offer a density of almost 3,400 PPI).

LG Display gets approved to supply AMOLEDs for the iPhone 16 Pro Max before Samsung Display

Reports from Korea suggest that Apple approved LG Display as a supplier for its upcoming iPhone 16 Pro Max, the most advanced iPhone model to be released this year. Interestingly, LGD apparently got the approval before Samsung Display, Apple's main OLED supplier.

If true, this is the first time that Apple approves LGD first. This does not necessarily mean anything, but it does mean that the technology gap between Samsung and LGD is low, if present at all. Samsung has much higher production capacity compared to LGD, note. The two companies will likely produce panels for all four iPhone 16 models, and it is reported that BOE will supply some panels for the two standard iPhone 16 models.

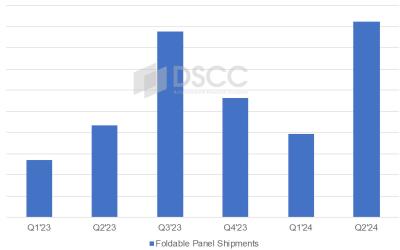

DSCC sees 9.25 million foldable OLED panels shipped in Q2 2024, with Samsung returning to a dominant position

DSCC says that foldable OLED shipments increased 46% in the first quarter of 2024 compared to last year, to reach almost 4 million units.

BOE was leading the market in Q1 2024, with a market share of 48% (up from 43% in Q1 2023). The two leading foldable smartphone models were Huawei's Mate X5 and Pocket 2, using panels supplied by BOE. In fact Huawei had a market share of 55% in the foldable smartphone market.

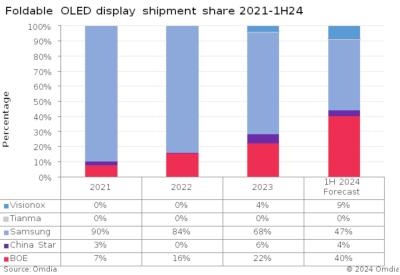

Omdia estimates that China's foldable OLED panel production will surpass Korea's in H1 2024

Omdia says that China's OLED makers have been making rapid progress with their foldable OLED capabilities, to the point that in the first half of 2024, China's production of foldable OLED panels will surpass Korea's.

Omdia predicts that in the first half of 2024, Samsung Display will produce 5.7 million panels, while China's producers will produce 6.4 million panels. The market is set to grow quickly, from 10.7 million units in 2021 to 30 million panels in 2024. The market leader remains Samsung (47% in 2024H1), followed by BOE (40%), Visionox (9%) and TCL CSoT (4%).

BOE shows new OLED displays at SID Displayweek 2024

BOE had a large demonstration at Displayweek 2024, showing several display technologies and many new panels and prototypes.

First up we have a slidable OLED display, one of the largest we've seen, at 31.6". The display offers a resolution of 5944x1672, a sliding distance of just over 260 mm (BOE says its the world's longest) and a sliding radius of 5 mm.

China's small-to-medium OLED production surpasses Korea's for the first time

According to Sino Research, in the first quarter of 2024, small-to-medium AMOLED production in China surpassed the production in Korea, by shipments, for the first time. China's market share was 53.9%, an increase from 44.9% in Q4 2023.

The leading producer is still Samsung Display, with a 41% market share (down from 53.3% last year). BOE has a market share of 17%, Visionox 12%, CSoT 10%, Tianma 9% and LGD 6%. The mean reason for the rise in China production and a decline in Korea's is lower shipments to Apple and an increase in the adoption of OLEDs in Chinese smartphones.

Samsung Display increases focus on small and medium AMOLED production

A report from Korea suggests that SDC has transferred around 500 of its engineers from its large-area OLED development division, or about 30% of them, to its divisions that focus on small and medium-sized AMOLED development.

Samsung tri-folding AMOLED prototype

According to the report, the main reason for SDC's change of priorities is due to the need to remain competitive with Chinese-based OLED makers that are offering OLED panels at low costs. Samsung estimates that it is ahead of its Chinese competitors by only a year or a year and half, and it is just a matter of time until Chinese companies catch up with South Korea makers (SDC and LGD).

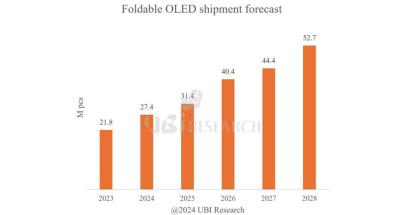

UBI: the foldable OLED market will grow to 52.7 million units in 2028, Samsung Display to remain the market leader

UBI Research released its latest foldable OLED shipments forecast, saying that it expects the market to grow from 27.4 million units in 2024 to 52.7 million 2028.

The market is dominated by Samsung Display, which shipped 13.4 million foldable OLEDs in 2023, and holds a 61% market. Samsung is followed by BOE (6.2 million, growing 3X from 2022), TCL CSOT (1.1 million) and Visionox (1.1 million). UBI expects Samsung Display to remain the clear leader in this market as it is the sole supplier to Samsung Electronics - and it is also expected that Samsung will be the exclusive supplier to Apple's future foldable iPhones.

BOE starts constructing its 8.6-Gen IT flexible AMOLED line in Chengdu

Towards the end of 2023, BOE officially announced its plans for a 8.6-Gen flexible LTPO AMOLED line in Chengdu. The agreement with Chengdu's local government was signed in early 2024, and now BOE started to construct its new production line.

The total investment in the fab is expected to reach 63 billion Yuan (over $8.7 billion USD). The fab will have a capacity of 32,000 monthly substrates (2290x2620 mm), and is expected to begin production by Q4 2026 (total construction time will be 34 months, according to the plan).

Pagination

- Previous page

- Page 3

- Next page