UBI Research: the OLED emitter market reaches a new high in Q3 2024

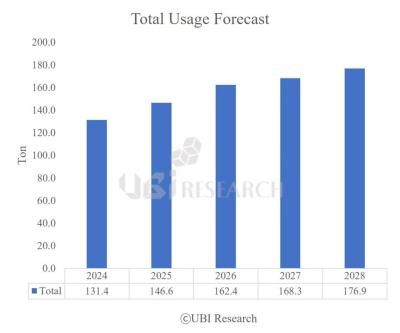

UBI Research estimates that the volume of OLED emitting materials purchased in Q3 2024 reached 32.7 tons, which is the highest ever, with the previous record in 2021. UBI expects 2024 as a whole to be the record year in OLED emitter material shipments.

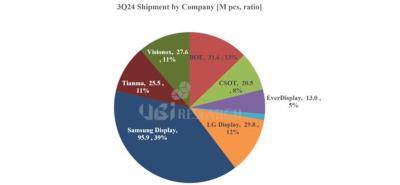

In terms of customers, SDC holds the largest share with 41.4% of the total market, followed by LGD (20.5%), BOE (11.6%) and Visionox (8.3%). In terms of architecture, 83.7% of all emitter materials went into RGB OLEDs, 11.3% into WOLED (LG's WRGB) panels and 2.8% into QD-OLED panels.