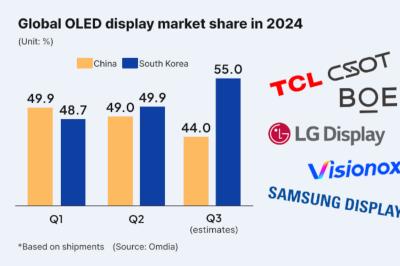

Reports suggest quality issues at BOE may shift iPhone OLED orders to Samsung Display and LG Display

Sources in Korea suggest that BOE struggles with supplying AMOLED panels to Apple's iPhone, and Apple may switch some of its orders to LG Display and Samsung Display.

BOE is supplying LTPS AMOLED displays to Apple's iPhone 14, 15 and 16 devices, but the company faces quality issues and Apple has rejected many of its displays. It is estimated that it will take at least 6 weeks for BOE to fix the OLED quality problems, and meanwhile since the beginning of 2024 it managed to ship only about 7-8 million panels to Apple - from orders of around 40 million units.