Apple aims to adopt lower-cost OLED microdisplays at future Vision Pro products, in talks with BOE and Seeya

Apple first VR headset, the Apple Vision Pro, adopts dual 1.3" 4K OLED microdisplays made by Sony. According to reports, Apple is looking to replace Sony as its supplier and is testing displays made by Seeya and BOE. Apple seems to be aiming to adopt these in its next-gen Vision Pro model - and also in a future low-cost mixed-reality headset.

Sony officially launched its 1.3" 4K OLED displays last week, with an official price of $1,000 per unit. Some reports suggest that Apple is paying $350 per display - which is still very expensive, as the two OLED displays cost almost half of the total production cost of the Vision Pro (estimated at $1,500).

Omdia: the automotive OLED market is set to grow to $2.17 billion in revenues by 2027

According to market research firm Omdia, the OLED automotive displays market is set to grow to $2.17 billion in 2027, up from $481.75 in 2023 (that's a 4.5X growth in sales). In terms of shipments, the market will reach 9 million units in 2027, up from 1.48 million in 2023 (a 7X growth).

Omdia is actually more optimistic about the automotive market than it was last year, as the industry is growing faster than expected. There is a rapid uptake of AMOLED displays in premium cars, as the displays offer a better image quality, lower power consumption and lower weight compared to LCDs, which is all very important for electric cars.

Tianma, BOE and Visionox report their latest financial results as profits decline, but demand for OLED panels increases

Three display makers in China (BOE, Tianma and Visionox) reported their preliminary financial results for the first half of 2023. It seems as if all companies are facing a sluggish economy and lower demand for displays - but the OLED business is actually seeing increased demand.

We'll start with BOE, that expects an operating profit of around 700-800 million Yuan ($97-110 million USD) in the first half of 2023, a decrease of around 90% from last year. BOE says that it is starting to see demand increasing as the year progresses.

Samsung Electronics stops its BOE OLED review process as the tension between the two companies rises

According to reports from Korea, Samsung Electronics considered adopting AMOLED display produced by BOE for its next flagship smartphone, but the company has halted the review process as the two companies are in the midst of an IP dispute.

A few months ago Samsung filed a motion with the US ITC to halt the import of aftermarket AMOLED displays produced by BOE. A group of OLED makers in China, which includes BOE, answered with a motion of their own, to dismiss an SDC AMOLED patent. This legal battle continues, and the tension between Samsung and BOE is on the rise.

UBI: the foldable OLED market will grow to 61 million units by 2027

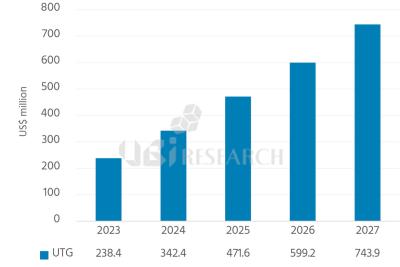

UBI Research estimates that the foldable OLED market will reach 22 million units in 2023, and will grow to 61 million units by 2027, a CAGR of 29%.

UBI also published a forecast on cover material market for foldable OLEDs - this market will also expand, and will grow to $840 million n 2027. UBI says that the market share of ultra-thin glass will grow, as Samsung will only produce foldable OLEDs with UTG in the future, and other makers including BOE, CSoT and Visionox are developing UTG panels.

Chinese OLED makers file a motion to dismiss a major SDC OLED patent in the US as the dispute of AMOLED imports to the US continues

Earlier this year, we reported that Samsung filed a request at the US International Trade Commission (ITC) to ban BOE's aftermarket AMOLED panels in the US, as they infringe on Samsung's OLED patent. Following the request, the ITC started a formal investigation.

According to a new report from China, several OED makers in China (BOE, Tianma, TCL CSoT and Visionox) have joined forces and filed a motion to invalidate one of Samsung's main OLED patents in the US. This is a response to SDC's request to halt BOE's US aftermarket AMOLED panel sales.

BOE demonstrates a 15" rollable OLED display

During Display Week 2023, BOE showcased a 15" 2560x1600 rollable OLED display.

The display offered a rollable radius of 10 mm (outwards), and can roll 50 mm of its length, changing from the full 15" 16:9 display to a 13.6" 24:9. This is not as impressive as Samsung's rollable demo that grew 5 times its original rolled size.

BOE developed a 1.3" 4K OLED microdisplay, hopes to supply it to Apple's future VR HMDs

During DisplayWeek 2023, BOE demonstrated a new OLED microdisplay. The panel is 1.3" in size, and it offers a 3552x3840 resolution (4031 PPI), a refresh rate of 90Hz, and a color gamut of 90% DCI-P3.

This is BOE's largest and highest-resolution OLED microdisplay to date. BOE's current OLED microdisplays, already in production, include a 0.39", 0.49" and 0.71" FHD panels (all of which are available on the OLED marketplace, by the way).

BOE is facing delays in its plan to build an 8.5-Gen IT OLED line

BOE has plans to construct an 8.5-Gen AMOLED production line with a capacity of 30,000 monthly substrates to produce IT displays for laptops, tablets and monitors. The company aims to build the B16 factory in Chengdu, Sichuan.

Asus ZenBook 17 Fold OLED (BOE panel)

According to Korea's ETNews, BOE is facing delays with its B16 plans. The company is seeking support from the local government, but it has yet to gain support.

BOE starts shipping a 0.49" FHD OLED Microdisplay, we offer it at the OLED Marketplace

BOE has started producing a new OLED microdisplay - a 0.49" Full-HD panel that offers a relatively low brightness (up to 700 nits). This new panel joins other microdisplays by BOE, including 0.39" and 0.71" ones, all with the same FHD resolution.

This new OLED microdisplay is listed at the OLED Marketplace, and we have access to this display. Contact us if you are interested in this display. We also list BOE's 0.39" FHD panel, and BOE's 0.71" one.

Pagination

- Previous page

- Page 6

- Next page