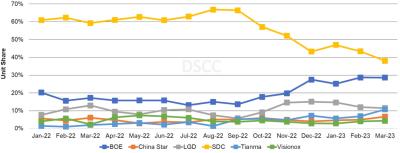

DSCC: BOE's market share in flexible smartphone OLED displays rose to 27%

DSCC says that BOE's market share in the flexible (and foldable) smartphone OLED market has risen to 27% in Q1 2023. BOE flexible and foldable OLED panel sales grew 81% in Q1 2023 compared to last year, as the company enjoys growing sales to Apple, Huawei, Oppo, Realme, Vivo and ZTE. BOE is mostly taking market share from Samsung and LG, while Tianma's market share is also on the rise.

DSCC estimates that flagship smartphone shipments grew 17% in the first quarter, with flexible OLED smartphone shipments growing 18% and foldable ones growing 4%.

Sigmaintell: production of OLED smartphone displays in China to jump 40% in 2023

Most analysts seem to agree that global demand for OLED displays is set to slow down in 2023. DSCC says that revenues will decrease 7% in 2023, led by a drop in demand for OLED smartphone and TV displays. Omdia also agrees, saying that OLED fab utilization remains low.

China-based Sigmaintaell, meanwhile, is optimistic on China's own OLED industry, expecting production to jump 40% in 2023. Sigmaintell says that Chinese phone makers are increasing their adoption of OLED displays in high-end and mid-range models. The company's analysts expect over 220 million Chinese OLED panels to ship in 2023, and China's OLED market share to rise to 38%, up from 28% in 2021.

The US ITC launches a formal investigation against BOE regarding Samsung's OLED patents

According to Business Korea, the US International Trade Commission (ITC) launched a investigation to check whether BOE infringes Samsung's OLED patents. This is a second step in Samsung's' efforts to ban BOE's AMOLED panels in the US, following a request to ban aftermarket AMOLED panels in the US.

This will be interesting to watch, especially as BOE aims to become a supplier for Apple's future iPhone displays.

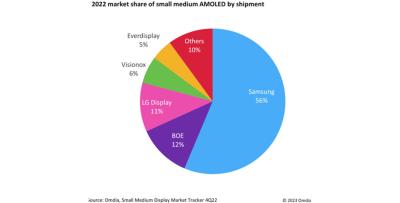

Omdia: small-size AMOLED display shipments down 6% in 2022

Omdia says that small-size (under 9") AMOLED display shipments dropped 6% in 2022 to 762 million units, due to lower demand for smartphones.

Samsung remains the leading AMOLED maker, with a 56% market share (by unit), down from 61% in 2021, with BOE in the second plane (12%) and LG Display in the third place (11%). The next producers by shipments are Visionox and Everdisplay.

Reports from Korea suggest that BOE is facing technical challenges as it struggles to become an OLED supplier for Apple's iPhone 15

According to reports from Korea, BOE is developing smartphone OLED displays for Apple's iPhone 15 range, but it is facing technical hurdles.

Specifically, the iPhone 15 design has a camera (and FaceID sensors) punch-hole inside the OLED, and BOE's panel suffer from light leakage from the OLED into the camera hole area.

DSCC says demand for smartphone and TV OLED displays will decline by 24% in the next quarter

DSCC says that OLED panel revenues were $12.6 billion in Q4 2022, down 3% from Q4 2021. Shipments declined by 7% compared to last year.

For the full year 2022, revenues reached $41.7 billion, a 1% decrease from 2021. AMOLED for smartphones shipments (units) decreased by 1%, while OLED TV panel shipments decreased by 9%. Some OLED segments grew in 2022 - AR/RV, automotive, monitors, and tablets.

BOE plans to build a $250 million OLED module fab in Vietnam

According to reports from Vietnam, BOE decided to invest $400 million to build two new display factories, one of which will be used to produce OLED display modules. The OLED module fab has an estimated cost of $250 million. The module plant will begin operation by 2025.

According to the report, BOE plans to produce smartphone OLED modules at the new fab.

Report: Samsung and HP to launch foldable OLED laptops in 2023, low demand for current such devices

The Elec reports that Samsung Electronics is set to launch a foldable OLED laptop next year, using a 17.3" AMOLED display produced by Samsung Display. HP is also gearing up to release its first foldabl OLED, with a 17-inch display produced by LG Display.

Asus ZenBook 17 Fold OLED

Foldable OLED laptops are exciting, but current prices are very high, and so demand is low. The Asus ZenBook 17 Fold OLED for example, which uses a 17.3-inch display made by BOE, costs $3,500 - a very high price for a laptop. It is reported that Asus only ordered 10,000 displays from BOE as it understand it cannot ship many units at this price, and HP also not planning for many sales of their own first-gen foldable laptops, and have ordered a similar number of displays.

UBI sees sales of rigid OLED panels to continue and decline, while flexible and foldable OLEDs are on the rise

UBI Research says that according to its latest information and forecasts, shipments of Samsung's rigid smartphone AMOLED displays declined to 19 million units in Q3 2022, a drop of over 50% compared to last year. Rigid smartphone OLED display sales will continue to decline at an annual rate of 12.9% and will reach only only 96 million units in 2027.

Flexible OLED sales will continue to increase at a rate of 7.4% from 2022 to 2027. In 2027, Samsung Display will ship 220 million flexible OLED displays, while BOE will ship 140 million OLEDs.

UBI Research: the OLED materials market will grow 8.6% annually to reach $2.75 billion by 2027

UBI Research says that according to its latest study, the OLED emitter market is set to grow from around $1.82 billion in 2022 to $2.75 billion in 2027, with an annual growth rate (CAGR) of 8.6%.

In 2027, UBI expects Samsung's emitter material orders to amount to $680 million - fueled by growth in foldable OLED panels. BOE's emitter material orders will reach $380 million, and LG Display's - $230 million.

Pagination

- Previous page

- Page 7

- Next page