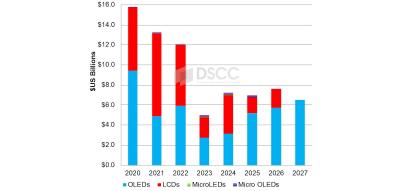

DSCC details the display industry's capital spending on equipment from 2020 to 2027

DSCC says that display makers are increasing their OLED CapEx investment as demand for OLED displays is on the rise. DSCC has raised its forecast for OLED spending by 14% compared to their previous update, while they retain their previous forecast for LCD, OLED microdisplay and microLED display equipment spending.

Between 2020 and 2027, OLED display makers will invest $44 billion in new production equipment. The spending on OLED equipment will keep growing year after year from 2023 to 2027, reaching $6.5 billion in 2027, as OLED penetration in the smartphone, tablet and laptop market is increasing, and fab utilization is increasing too, encouraging display makers to add capacity.

Visionox developed the world's first AMOLED driver IC with embedded RRAM

Visionox announced that together with Sunrise Display Microelectronics and Hefei Reliance Memory it has developed the world's firs AMOLED device driver that is powered by RRAM memory.

All AMOLED drivers on the market use a combination of SRAM memory, OTP (one-time programmable memory) and external Flash memory (for non-volatile memory), mostly to perform the Demura compensation function. The RRAM memory enables lower cost of production, higher efficiency - and smaller area.

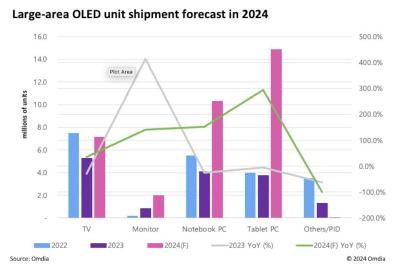

Omdia: shipments of OLEDs over 9-inch in size will soar 124% in 2024

According to Omdia, sales of OLED panels in sizes over 9-inch (the company refers to these as Large Area Displays) will increase 124.6% in 2024. In 2023, the market contracted 25.7%, with the only exception being OLED monitor panels that grew in shipments.

In 2024, Omdia says that all application areas will see an increase in shipments - TVs, monitors, tablets and laptops. Only the company's "other" category will see a decrease in sales. In particular, tablet OLED shipments are projected to increase by 294% compared to 2023, largely due to Apple's adoption of OLEDs in the 2024 iPad Pro tablets. Laptop OLED sales will increase 152.6%, and monitors OLEDs will increase 139.9%. Finally, OLED TV panel shipments will increase 34.8%.

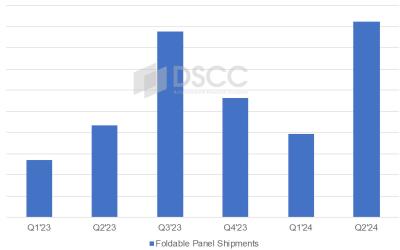

DSCC sees 9.25 million foldable OLED panels shipped in Q2 2024, with Samsung returning to a dominant position

DSCC says that foldable OLED shipments increased 46% in the first quarter of 2024 compared to last year, to reach almost 4 million units.

BOE was leading the market in Q1 2024, with a market share of 48% (up from 43% in Q1 2023). The two leading foldable smartphone models were Huawei's Mate X5 and Pocket 2, using panels supplied by BOE. In fact Huawei had a market share of 55% in the foldable smartphone market.

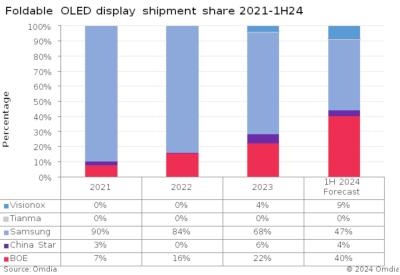

Omdia estimates that China's foldable OLED panel production will surpass Korea's in H1 2024

Omdia says that China's OLED makers have been making rapid progress with their foldable OLED capabilities, to the point that in the first half of 2024, China's production of foldable OLED panels will surpass Korea's.

Omdia predicts that in the first half of 2024, Samsung Display will produce 5.7 million panels, while China's producers will produce 6.4 million panels. The market is set to grow quickly, from 10.7 million units in 2021 to 30 million panels in 2024. The market leader remains Samsung (47% in 2024H1), followed by BOE (40%), Visionox (9%) and TCL CSoT (4%).

Visionox announces plans to build a $7.6 billion 8.6-Gen AMOLED line in Hefei

Visionox is the latest company to announce a new AMOLED production line, targeting the IT display market - laptops, monitors and tablets. The company said that it will best 55 billion Yuan (around $7.6 billion USD) to build a 8.6-Gen production line in Hefei, Anhui province.

Visionox's production line will have a monthly capacity of 32,000 substrates. The company did not share any details regarding the timeline of this project, or its financing.

Visionox shows its latest OLED and MicroLEDs at Displayweek 2024

During Displayweek 2024, Visionox demonstrated many OLED display technologies and panels, and also an interesting microLED prototypes (produced by its subsidiarity Vistar).

Visionox is in the final stages of development of its ViP maskless display production process, and the company showcased some nice ViP smartphone panel prototypes (the technology can be used for any panel size). ViP offers a high improvement in aperture ratio (69% up from 29%) which results in low power consumption and brightness (up to 4X according to Visionox), improved lifetime (up to 6X), improved PPI and more.

China's small-to-medium OLED production surpasses Korea's for the first time

According to Sino Research, in the first quarter of 2024, small-to-medium AMOLED production in China surpassed the production in Korea, by shipments, for the first time. China's market share was 53.9%, an increase from 44.9% in Q4 2023.

The leading producer is still Samsung Display, with a 41% market share (down from 53.3% last year). BOE has a market share of 17%, Visionox 12%, CSoT 10%, Tianma 9% and LGD 6%. The mean reason for the rise in China production and a decline in Korea's is lower shipments to Apple and an increase in the adoption of OLEDs in Chinese smartphones.

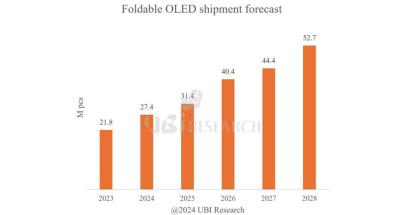

UBI: the foldable OLED market will grow to 52.7 million units in 2028, Samsung Display to remain the market leader

UBI Research released its latest foldable OLED shipments forecast, saying that it expects the market to grow from 27.4 million units in 2024 to 52.7 million 2028.

The market is dominated by Samsung Display, which shipped 13.4 million foldable OLEDs in 2023, and holds a 61% market. Samsung is followed by BOE (6.2 million, growing 3X from 2022), TCL CSOT (1.1 million) and Visionox (1.1 million). UBI expects Samsung Display to remain the clear leader in this market as it is the sole supplier to Samsung Electronics - and it is also expected that Samsung will be the exclusive supplier to Apple's future foldable iPhones.

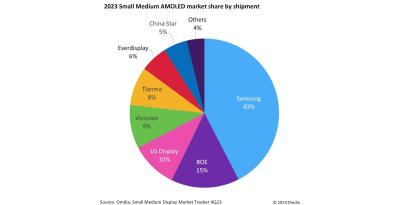

Omdia: Samsung leads the small and medium AMOLED market with a 43% market share in 2023

Omdia released its small and medium (9-inch and lower) AMOLED market share information for 2023, saying that even though Samsung's market share was lower than 50% for the first time, it stills leads the market by a large margin, with a 43% market share.

Samsung is followed by BOE (15%), LG Display (10%), Visionox (9%) and Tianma (8%). The total market reached 842 million units, a growth of 11% over 2022. Omdia says that the China-based OLED makers have been expanding their capacity and improving the quality of the produced panels, and are securing orders from domestic smartphone brands.

Pagination

- Previous page

- Page 2

- Next page