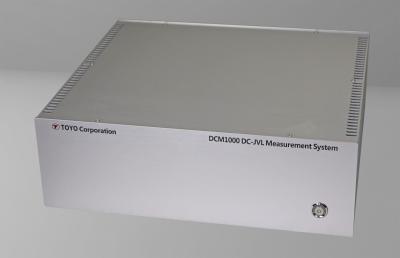

TOYOTech, Sharp Display Technology Corporation (Mie, Japan), and the Japan Advanced Institute of Science and Technology (Ishikawa, Japan) have developed a novel measurement technology to analyze the behavior of Organic Light Emitting Diodes (OLEDs) under extremely low luminance conditions.

This new technology measures the gap between the onset voltage of current change and the emission voltage—factors closely linked to OLED degradation. It is expected to play a critical role in analyzing display Mura, a defect that appears in low luminance or as OLEDs degrade.

OLEDs emit light when a voltage is applied to organic compounds, enabling the creation of displays that are thinner, lighter, and more energy-efficient, suitable for devices like TVs and smartphones. Unlike Liquid Crystal Displays (LCDs), OLEDs have a simpler structure due to their self-emissive properties, which eliminate the need for a backlight. OLEDs are formed by stacking multiple layers of thin films, and their performance depends on optimizing deposition conditions. Traditionally, these characteristics have been evaluated using J-V-L (current density-voltage-luminance) measurements, which track current and luminance as voltage is applied. However, J-V-L technology has limitations in detecting small currents and low luminance levels at the start of OLED light emission.