DSCC: the OLED material market will reach $2 billion in 2022

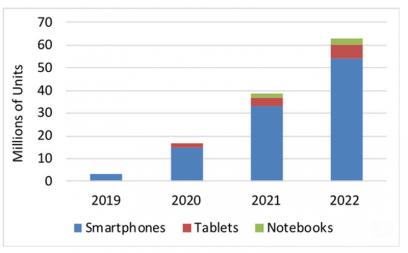

DSCC has updated its OLED material market forecast, saying that it expects the market to grow from $829 million in 2017 to $2.04 billion in 2022 (a 20% annual CAGR).

DSCC recently revised its OLED market estimation - as it lowered its forecast of mobile application demand while increasing its outlook for OLED TV capacity. Total OLED capacity is still expected to increase almost 4X from 2017 to 2022. DSCC expects OLED TV material revenues to surpass mobile OLED revenues by 2022.