Korea's The Elec says that Samsung Display aims to start trial runs at its QD-OLED 8.5-Gen production line next month (December 2020).

SDC will brand these displays as QD Displays. The first generation ones will adopt SDC's current hybrid QD-OLED architecture, but later ones may adopt QNED (quantum-rods) emitters. In any case, SDC's plan is to start mass production by the end of 2021, in the first line (15,000 monthly substrates). SDC is also planning a second line to follow the first, to arrive at a total of 30,000 monthly 8.5-Gen substrates.

SDC's further QD-OLED investment decisions will wait for around May 2021. The company wants to stabilize production yields and start approaching customers to secure design wins. Interestingly it seems as if Samsung Electronics may actually not buy any such panels from SDC - which will have to look for other customers. SDC reportedly already shipped samples to Sony and Panasonic.

According to earlier reports, in addition to QD-OLED TV panels (55-, 65-, 78- and 82-inch) SDC may also use the technology to produce 27-inch and 32-inch 8K gaming monitors. By adopting MMG technology, it will be able to produce two 82-inch and three 32-inch panels on the same 8.5-Gen substrate, or two 78-inch and six 27-inch panels.

In October 2019 Samsung Display formally announced its decision to invest $10.85 billion in QD-OLED TV R&D and production lines (this also includes an investment in QNED R&D). In the long run SDC plans to convert all its 8-Gen LCD lines (360,000 monthly substrates) to QD-OLED production (which will yield around 100,000 monthly QD-OLED substrates).

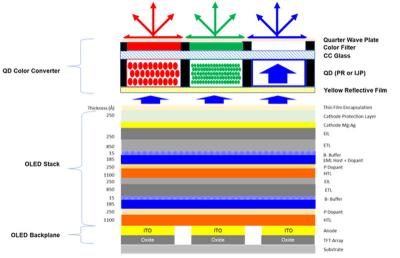

According to DSCC, Samsung's QD-OLEDs will offer several advantages compared to LG's current WRGB (four subpixels + color filters) system. Samsung will be able to use three sub pixels and only two emitting layers (LGD uses four), and so its stack will include 13 layers compared to 22 layers in LGD's TVs - which means fewer deposition stages, improved yields and lower material costs.

In fact, DSCC estimates that a square meter of QD-OLED production will require materials that cost around $26 - compared to almost $95 in a meter of WOLED production.

You can see DSCC's QD-OLED revenue forecast here - although they admit that as Samsung faces several technical challenges before it could launch commercial QD-OLED TVs, its forecast could be way off.

The two main challenges for QD-OLEDs, according to DSCC, are efficient blue OLED emitters and a good quantum-dot color converter (QDCC). Light management in this architecture is also a serious challenge. The first generation panels will adopt an fluorescent blue OLED emitter, but to achieve higher efficiencies and lifetimes, the company is looking into QNED technology - but if an efficient blue OLED emitter (PHOLED, or TADF?) will become commercially available, it is likely that it will also be a candidate for SDC's next-gen QD Display emitter tech.