A senior researcher formerly working at Samsung Display sentenced for 6 years in prison for OLED trade secrets

In 2021, we reported that two researchers working at Samsung Display were convicted of handing over OLED technology to other companies, and are being sent to prison for two years. There was another employee, the main organizer of the outfit, who was also facing trial - and now it is reported that he was sentenced for 6 years in prison.

The researcher was accused of illegally acquiring trade secrets - technologies related to OLED ELA (Excimer Laser Annealing, used to process a-Si into LTPS backplanes) and OCR used in OLED inkjet printing processes. The researcher has acquired these technologies and intended to sell them to Chinese companies in in 2018 - 2020. The prosecution said that the trade secrets' worth was at least $250 million USD.

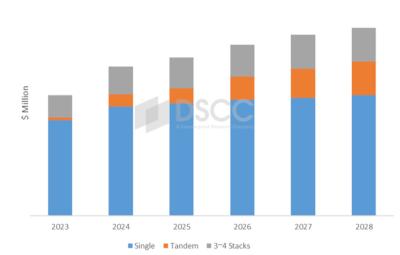

DSCC: the OLED materials market to grow 24% in 2024, will reach $2.7 billion by 2028

DSCC says that the OLED materials market will reach $2.12 billion in 2024, rising 24% over 2023. The market will continue growing at a 6% CAGR until 2028, reaching about $2.7 billion. DSCC details the revenue split between single-stack, tandem and multi-stack panels, saying that materials used in tandem OLED panels will grow at a fast rate of 30% CAGR from 2024-2028.

The leading materials makers by revenue in 2024 will be UDC, DuPont, LG Chemical and Samsung SDI, holding a market share of 51% together. DSCC says that Chinese materials makers will increase their market share in the future.

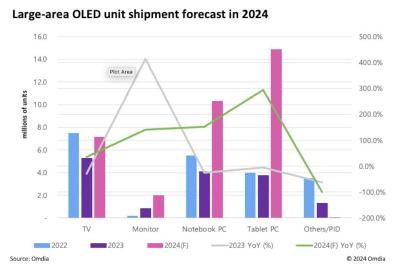

Omdia: shipments of OLEDs over 9-inch in size will soar 124% in 2024

According to Omdia, sales of OLED panels in sizes over 9-inch (the company refers to these as Large Area Displays) will increase 124.6% in 2024. In 2023, the market contracted 25.7%, with the only exception being OLED monitor panels that grew in shipments.

In 2024, Omdia says that all application areas will see an increase in shipments - TVs, monitors, tablets and laptops. Only the company's "other" category will see a decrease in sales. In particular, tablet OLED shipments are projected to increase by 294% compared to 2023, largely due to Apple's adoption of OLEDs in the 2024 iPad Pro tablets. Laptop OLED sales will increase 152.6%, and monitors OLEDs will increase 139.9%. Finally, OLED TV panel shipments will increase 34.8%.

Samsung announces the Z Flip6 and Z Fold6 foldable smartphones, and two new OLED wearables

Samsung announced today four new devices - two foldable smartphones, and two smartwatches, all with AMOLED displays. All of these devices will ship on July 24.

First we have the latest clamshell smartphone, the Galaxy Z Flip6 - that has a foldable 6.7" 120Hz 2,600 nits 1080x2640 LTPO AMOLED display. It also has a 3.4" 720x748 Super AMOLED cover display.

ETNews: Samsung Display to supply its latest M14 AMOLED panels to Apple and Google

ETNews reports that Samsung Display has developed a new OLED stack, the M14 stack, that it will sell to both Apple and Google to be used in their latest smartphones. The new stack improve the efficiency, lifetime and brightness of the display compared to SDC's previous generation stack.

According to ETNews, the new M14 stack will be used int he upcoming iPhone 16 Pro and Pro Max. Apple's regular iPhone 16 models will use the previous AMOLED stack, Samsung's M12. Google will also adopt the M14 stack in its Pixel 9 (all 3 model types) and the upcoming Pixel Fold 2.

Samsung sold over 20,000 of its new QD-OLED gaming monitors in a month

Samsung Electronics says that a it has sold over 20,000 units of its new QD-OLED monitors, the Odyssey G8 and G6 in a month. The company says that the new monitors are popular in Europe, North America - and Southeast Asia.

A couple of months ago IDC says Samsung is leading the OLED monitor market, with a 34.7% market share by revenue (and 28.3% market share by shipments. Samsung Electronics started selling OLED monitors in 2023.

Is LG Display leading over Samsung Display with the quality and performance of its latest OLED?

Since Samsung started mass producing AMOLED displays in 2007, most people believe that the company is not only the leader in OLED production capacity, but also in the performance of its displays. In most cases, Samsung has been the first company to develop and manage to mass produce the most advanced OLED displays, and the first to adopt the latest OLED materials, architectures, and processes.

There are some signs that this could be changing, although honestly it's a bit too early to know. In May 2024, Apple launched its first OLED Tablets, and according to reports, Apple chose LG Display as its main supplier, ordering around 60% of its iPad OLEDs from LGD (with all of the 13" model orders going to LG), and the rest from Samsung. Later it was reported that Apple had to delay the introduction of its 2024 iPad Pro devices as Samsung faced low production yields and could not deliver displays in time.

Apple reportedly reaches out to Samsung and LG regarding the supply of OLED microdisplays

According to a report from Korea, Apple has sent an RFI for both Samsung Display and LG Display, seeking more information about the two companies capabilities regarding the production of OLED microdisplays. It is speculated that Apple is seeking to change its OLED supplier in a future, lower-cost VR headset.

Apple specifically mentions a white OLED with color filters architectures (i.e. not a direct-patterned device), a panel size of 2 to 2.1 inch and a display density of around 1,700 PPI (which is rather low, Sony's 4K microdisplays used in the Apple Vision Pro for example offer a density of almost 3,400 PPI).

Reports suggest that Poongwon Precision will start mass producing 6-Gen FMM masks in Q3 2024, following approval by Samsung Display

According to a report from Korea, following several years if R&D, Poongwon Precision has finally achieved high enough FMM quality and production yields to receive an approval from Samsung Display.

The company is now gearing up to start mass producing 6-Gen FMM sheets in Q3 2024, and expects to receive the first orders from Samsung Display in September. The company is also in talks with BOE and CSoT for the supply of FMM (although it seems that it will focus on SDC until at least 2027).

UTG glass developer Dowoo Insys plans to IPO in 2025

A report from Korea suggests that Dowoo Insys is planning to IPO in 2025. The company will list on the Korean Exchange, and it plans to file the preliminary information and documents by the end of the summer.

Dowoo Insys was established in 2010, to develop glass products for the display industry. The company's main product is thin flexible glass covers for foldable displays - UTG glass - which it supplies to Samsung Display (its main customer). Dowoo does not produce its own glass - it buys flexible glass from Schott and then treats it in its own facilities.

Pagination

- Previous page

- Page 4

- Next page