DSCC posted an interesting article detailing their estimates for the production costs and prices of choice flexible and foldable AMOLED displays, in China and in Korea.

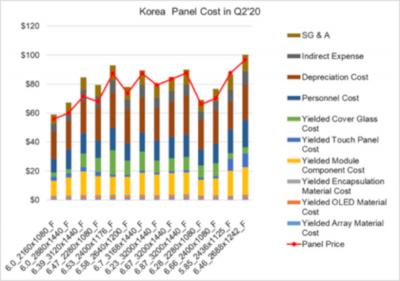

We'll start with the chart above, which compares the prices and quotes of several flexible OLEDs produced by Samsung in Korea. DSCC says that as the profitability of Samsung's OLED business is highly dependent on fab utilization, it is currently losing money on this business as the yields in its flexible OLED lines are only 38% - and fixed costs such as personnel and depreciation cannot be decreased. Having said that, DSCC sees higher utilization in the next two quarters, which will result in profitability for SDC's OLED unit.

The next chart (above) compares the cost of production of a 6.47" FHD+ flexible OLED display, in Korea (left) and China (right), from 2019 to 2021. The higher yields in Samsung's fabs enabled it historically to produce at lower costs, but as we said above, the costs in Korea fluctuated greatly with utilization changes, and in 2020 the total production cost in China is lower than in Korea due to lower personnel and depreciation costs.

DSCC is also looking into two specific panels. First is the 6.7" 2636x1080 foldable OLED produced for the Galaxy Z Flip.DSCC says that in 2020 production of foldable OLEDs is still unprofitable (due to overall low utilization on Samsung’s flexible lines) - but profitability will improve steadily and lower prices will follow.

Finally, DSCC details the prices of the OLED panels sold to Apple in 2020, for its current and next-generation iPhone devices. Compared to 2019, Korean makers will be able to produce OLEDs at lower cost for Apple. Interestingly, the 6.67-inch AMOLED is 14% lower in cost compared to the 6.46-inch panel - due to the switch from force touch to Y-OCTA.