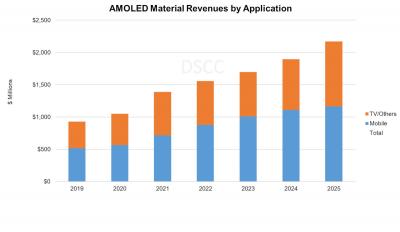

DSCC updated its AMOLED material market forecast, saying that the market will reach $1.4 billion in 2021 (up 32% from 2020), and grow at a 16% CAGR from 2019 ($927 million) to 2025, to reach $2.18 billion by 2025.

DSCC takes a look into the material cost for LG Display's WOLED TV panels. LGD will likely manage to implement incremental improvements in material utilization and price, which will enable the company to almost halve the material cost of its TV panels- from $88.14 per sqm in 2019 to $47.19 per sqm by 2025.

LG's new Evo architecture, with its added green emitting layer, adds around $20 per sqm (this will also decline in time of course). Due to the added costs, DSCC expects Evo panels to be only used in premium products (around 10% of LG's total WOLED market in 2025).

DSCC says that the OLED material cost of Samsung's upcoming QD-OLED panels will be substantially lower than those for WOLED - around 25% lower in 2021. This is for an unyielded panel. It is likely that SDC's QD-OLED yields will be quite lower compared to LGD's yields, at least in the first few years. Also, DSCC expects the color filters on the QD-OLED to be substantially more expensive than the color filter used in WOLED. All things consider, the total cost of production for QD-OLED panels will be higher compared to the total cost of WOLED production.

Looking at inkjet processes, DSCC expects CSoT to start OLED TV production using inkjet panel in its upcoming 8.5-Gen fab by 2024, which will increase the market for soluble OLED materials in 2024-2025. DSCC expects revenues from soluble materials for inkjet-printed OLED will grow from less than $1 million in 2019 to $171 million in 2025.

DSCC expects UDC, Idemitsu Kosan, Novaled and Merck to remain the four leading material makers in the forecast period. These four companies hold 60% of the total market in 2021.