Reports from Korea suggest that BOE and CSoT are looking to establish 8-Gen AMOLED fabs

As demand for larger mobile OLED displays, for laptops, tablets and monitors is on the rise, there are reports that Samsung Display is considering building a 8.5-Gen AMOLED fab dedicated for laptop and IT displays. SDC is developing technologies to overcome the limitation in OLED deposition.

According to a new report from Korea, China's BOE and CSoT are both looking to also establish 8-Gen OLED production lines. BOE is accelerating its plans for a 2200x2500 (8-Gen) OLED deposition line, and is developing deposition technologies towards that goal. BOE's main target is to produce smartphone OLED displays, which it hopes to supply to Apple.

BOE given a conditional approval to supply AMOLED displays to Apple's iPhone devices

According to reports from Korea, Apple has given BOE a "conditional approval" for iPhone panel supply. BOE hasn't been able to meet 100% of Apple's requirements, but it is now given time to fix these issues, and may be able to become a supplier to Apple if all goes well.

Even if BOE manage to satisfy Apple, it will take some time and so it is likely that it won't receive large orders for the iPhone 13 series. Apple currently buys all of its iPhone AMOLED panels from Samsung Display and LG Display. BOE aims to supply the panels for the standard iPhone 13 (not the Pro series).

DSCC: Smartphone OLED shipments to rise sharply in 2021

DSCC says that smartphone OLED shipments have increased around 50% in Q1 2021 compared to last year, and the growth will continue - around 30% in Q2 2021 and over 40% in Q3.

The market share of flexible AMOLEDs out of all OLEDs (rigid + flexible) continues to rise, and in Q1 2021 77% of all smartphone OLED displays were flexible ones. Samsung is still the largest producer by far, holding a 75% market share in Q1 2021. LG Display holds a 8% share and BOE 6%.

UBI: the OLED materials market will grow 17% in 2021 to $1.52 billion USD

UBI Research says that the OLED materials market will grow 17% in 2021 to $1.52 billion USD (up from $1.3 billion in 2020).

Korean OLED makers are the main customers for OLED materials, with 74.3% of the total market, while China producers represent 25.7% of the market. Samsung Display is still the leading OLED materials customers with 45.9% of the total market, LGD is second with 28.5% and BOE third with 13.7%.

BOE shows new OLED technologies at SID Displayweek 2021

BOE demonstrates several new OLED technologies at SID Displayweek 2021. First up is a new rollable display. The new display is 8-inch in size, and it features a resolution of 2592x2176 and a bending radius of 4 mm. BOE says the new display passed over 200,000 sliding cycles.

Last year at Displayweek 2020, BOE demonstrated a 12-inch rollable OLED. It has since been working with LG Electronics on the company's rollable smartphone (which was since canceled as LG withdrew from the smartphone market) and with OPPO on a 7.4-inch sliding OLED phone.

OLED production will grow 94% in Q2 2021, as demand for OLED panels increases

DSCC says that OLED production will grow 94% in the Q2 2021, fueled by strong demand for OLED in smartphones, TVs and other devices - coupled with a recovery from the pandemic. Growth in OLED input area for small & medium displays is expected to grow 68%, while grow in OLED TV input area will grow by 134% over last year.

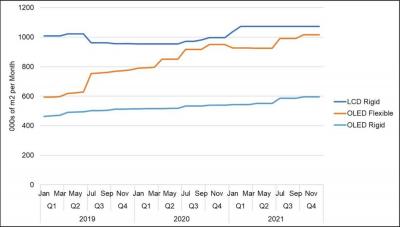

The chart above shows the total OLED (and mobile LCD) industry capacity. As you can see, flexible OLED capacity is growing - mainly from expansions by CSoT, Tianma and Visionox. There's also growth in rigid OLED capacity - from Everdisplay and JOLED.

BOE and Himax announce an electric vehicle design-win for a 12.8-inch flexible AMOLED

Himax Technologies, together with BOE Varitronix (automotive display product supplier) announced that they secured a design-win with a leading new electric vehicle maker.

The customer will soon launch a flagship automobile, which will sport a 12.8-inch flexible AMOLED center information display product. The new solution includes a flexible AMOLED display produced by BOE and a Himax AMOLED driver IC and timing controller system.

Samsung Electronics to adopt flexible OLED panels produced by BOE

In 2020 it was reported that Samsung Electronics is set to use AMOLED displays produced by China's BOE in some of its smartphones. It was later reported that BOE failed to pass Samsung's quality tests.

According to a new report from Korea, BOE finally managed to pass Samsung's tests and is set to start supplying flexible OLEDs that will be used in Samsung's budget Galaxy M series of smartphones.

UBI: The OLED market grew only 0.7% in 2020, details revenue by company

UBI Research says that shipments of OLED displays reached 577.88 million in 2020, up 3.7% from 2019. Total OLED revenues in 2020 increased only 0.7% to $32.68 billion as average panel price was lower in 2020 (mostly in the smartphone market).

The main growth in the OLED industry in 2020 came from smartwatches and TVs markets. Smartphone and tablet display shipments actually decreased in 2020. In 2020, new market emerged - automotive displays, laptop displays and foldable devices.

Will BOE start producing panels for Apple's iPhone 12?

In November 2020 it was reported that BOE did not pass Apple's OLED quality test for the iPhone 12. Later it was suggested that BOE did manage to enter Apple's supply chain, although perhaps only for aftermarket (refurbished models) panels.

According to new reports from China and Korea, BOE has been finally approved as a third OLED supplier (besides Samsung Display and LG Display) for Apple's iPhone 12 - the mini and standard models (and not the higher-end iPhone 12 Pro).

Pagination

- Previous page

- Page 11

- Next page