LG Chem (part of the LG Group) is developing and marketing chemicals and electronic materials. For the OLED display market, LG Chem is offering OLED stack materials.

LG Chem (part of the LG Group) is developing and marketing chemicals and electronic materials. For the OLED display market, LG Chem is offering OLED stack materials.

In July 2017, Idemitsu Kosan and LG Chem announced a new collaboration agreement that will allow both companies to use each other OLED material-related patents in certain areas.

LG Chem was producing OLED lighting panels, but in 2015 the company sold the OLED lighting business unit to LG Display is a $135 million deal (LGD later withdrew from the market). LG Chem also had an OLED circular polarizer business, which was sold in 2023.

LG twin tower

20 Youido Dong st.

Yeongdeungpo-gu

Seoul

South Korea

DSCC: the OLED materials market to grow 24% in 2024, will reach $2.7 billion by 2028

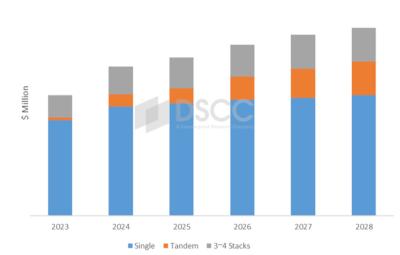

DSCC says that the OLED materials market will reach $2.12 billion in 2024, rising 24% over 2023. The market will continue growing at a 6% CAGR until 2028, reaching about $2.7 billion. DSCC details the revenue split between single-stack, tandem and multi-stack panels, saying that materials used in tandem OLED panels will grow at a fast rate of 30% CAGR from 2024-2028.

The leading materials makers by revenue in 2024 will be UDC, DuPont, LG Chemical and Samsung SDI, holding a market share of 51% together. DSCC says that Chinese materials makers will increase their market share in the future.

ETNews: Samsung Display to supply its latest M14 AMOLED panels to Apple and Google

ETNews reports that Samsung Display has developed a new OLED stack, the M14 stack, that it will sell to both Apple and Google to be used in their latest smartphones. The new stack improve the efficiency, lifetime and brightness of the display compared to SDC's previous generation stack.

According to ETNews, the new M14 stack will be used int he upcoming iPhone 16 Pro and Pro Max. Apple's regular iPhone 16 models will use the previous AMOLED stack, Samsung's M12. Google will also adopt the M14 stack in its Pixel 9 (all 3 model types) and the upcoming Pixel Fold 2.

DSCC: the OLED materials market to grow from $1.7 billion in 2023 to $2.7 billion in 2027

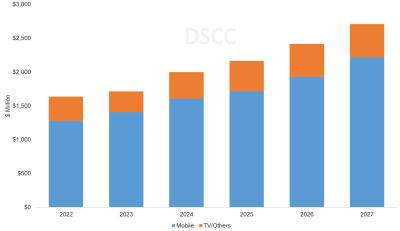

DSCC estimates that the market for OLED evaporation materials (i.e. OLED stack materials) will reach $1.7 billion in 2023, and will grow to $2.7 billion in 2027 (a 11% CAGR from 2023). If UDC will succeed to commercially introduce a blue phosphorescence material, revenues can even be much higher.

OLED materials used in TV applications (and other large-area applications) will grow from $305 million in 2023, to $492 million in 2027, a 13% CAGR. DSCC also sees very fast growth in material used to produce tandem-structure IT displays, which will grow at a 79% CAGR to reach $443 million in 2027.

LG Display and LG Chem developed new OLED dopant materials

LG Display announced that it has developed new OLED "p-Dopant" materials, in collaboration with LG Chem. The two companies have been working together for around 10 years, and they say that the new developed material matches the efficiency and performance of its currently-used materials imported into Korea.

LG Display already committed to use the new materials in both its large-area WOLED production lines and the small and medium mobile AMOLED lines.

LG Chem sells its display polarizer business for $800 million

In 2020, LG Chem announced that it has sold most of its LCD polarizer business to China’s Ningbo Shanshan, in a $1.1 billion deal. LG Chem retained its automotive LCD polarizer and its OLED polarizer businesses. The company now announced that it sold all of its remaining display polarizer business to two companies, for around $800 million deal - the polarizer materials business to Hefei Xinmei Materials Technology ($616 million) and the polarizer production business to Shanjin Optoelectronics ($200 million).

LG Chem aims to focus on its main growth engines, namely battery materials, green materials and life sciences. The company did not detail its plans for its remaining OLED businesses.

LG Chem starts to supply blue OLED host materials to BOE

Reports from Korea suggest that BOE has decided to adopt LG Chem's blue host material in its AMOLED displays, replacing its current supplier, Idemitsu Kosan.

LG Chem has been focused on soluble OLED materials, and it acquired Dupont's soluble OLED IP in 2019. But in recent years it has started to develop evaporation OLED materials, and it has now secured the design win at BOE. It is understood that BOE chose LG Chem over Idemitsu as its materials offer longer lifetime and lower costs.

LG Chem starts supplying deuterium blue OLED emitters to LG Display

Last year LG Display unveiled its latest OLED TV technology, branded as OLED EX, which uses a deuterium-based blue emitter materials, that enabled that LG to increase brightness by up to 30%. These panels are now adopted in LG's higher-end OLED TV panels.

According to a report from Korea, the deuterium-based blue emitters were supplied to LGD by DuPont. But the company has also been working its affiliate LG Chem to develop the capabilities to produce a similar deuterium emitter, and now LG Chem is starting to supply some of these materials to LGD.

LG Chem developed a PET-based foldable OLED cover film, says it is more durable than Polyimide and UTG

LG Chem announced that it has developed a new PET-based foldable OLED cover film. LGC says its new film is thinner and more durable than both polyimide films and Ultra-Thin Glass, currently used in foldable OLEDs.

LG Chem designed new materials, which are coated on both sides of the PET film to strengthen its heat resistance and mechanical properties. The company says the new film withstands over 200,000 folding cycles.

LG Chem sells its LCD polarizer business, to focus on its OLED polarizers

LG Chem announced that it has sold most of its LCD polarizer business to China’s Ningbo Shanshan, in a $1.1 billion deal. LG Chem will retain its automotive LCD polarizer business, and aims to focus on "strengthening its competitiveness in tech materials, especially OLED and nurture its OLED polarizer business". In 2018 DSCC estimated that the OLED circular polarizer market will grow from $428 million in 2017 to $1.27 billion in 2022. The market is still dominated by mobile displays. In 2018 the OLED circular polarizer market was led by Sumitomo Chemical and Nitto Denko, with LG Chem increasing its market share in OLED TVs polarizers.

In 2018 DSCC estimated that the OLED circular polarizer market will grow from $428 million in 2017 to $1.27 billion in 2022. The market is still dominated by mobile displays. In 2018 the OLED circular polarizer market was led by Sumitomo Chemical and Nitto Denko, with LG Chem increasing its market share in OLED TVs polarizers.

DSCC - OLED material sales will grow from $951 million in 2019 to $2.69 billion in 2024

DSCC updated its OLED material market estimates, saying that AMOLED stack material sales will grow from $951 million in 2019 to $2.69 billion in 2024 - a CAGR of 23%. These new estimates take into account DSCC's reduced input area forecast due to the slowdown in demand cased by the Covid-19 pandemic.

DSCC says that incremental improvements in material utilization and price reductions, material costs per square meters will decline in the future. The unyielded cost of producing a square meter of a WOLED TV panel will decline from $95.21 in 2019 to $56.11 in 2024.

Pagination

- Page 1

- Next page