QD-OLED displays - Page 10

Business Korea - Samsung to invest $10.85 billion in QD-OLED TV production

Business Korea says that Samsung Display has finalized its QD-OLED TV production plans. The company will invest 13 trillion Won (around $10.85 billion) to convert its L8 LCD production line in Tangjeong to QD-OLED production.

According to the report, SDC's investment will be the single largest investment in Korea's display industry ever. The L8-1-1 LCD line will be shut down immediately, and converted to QD-OLED production. SDC will also shut down its second line (L8-2-1) and in total the two fabs will be able to produce 200,000 8-Gen glass substrates each month (down from the current 360,000 substrates in LCD production today). Mass production of QD-OLED panels will begin in 2022.

Samsung Display's CEO confirms SDC will launch QD-OLEDs in the near future

Samsung has been developing its QD-OLED TV technology for a long time, but the company did not yet commit to actual production. Now Samsung Display's CEO officially announced that the company is "making good efforts" to launch QD-OLED panels in the "near future".

SDC has decided to shut down on of its 8.5-Gen LCD lines in Asan Korea, which will be converted to QD-OLED production in the future.

CSoT demonstrated new OLED display prototypes and technologies at SID DisplayWeek 2019

China-based display maker CSoT demonstrated several new OLED display prototypes and technologies at SID 2019, and this great new video shows these displays in action.

First up is a 31" 4K (3840 x 2160, 144 PPI) AMOLED that was produced using an ink-jet printing process on an IGZO substrate. The peak brightness is 200 nits and the refresh rate is 120 Hz. This seems to be the same panel announced in March 2018 by Joshua Printing Display Technology (established by CSoT and Tianma in 2016). The display has some noticable defects.

Business Korea: Samsung to decide on its QD-OLED TV plans soon

Samsung has not committed yet to its QD-OLED TV technology, and according to a new report from Korea the company will make its final decision by the end of June (or early July). Samsung originally planned to hold an investment review committee on April 2019 but that did not materialize. According to an industry insider, Samsung already decided to start QD-OLED TV production, the only question is timing.

Samsung's plan is to shut down an LCD TV production line and convert it to QD-OLED production - although Business Korea now suggests that another possibility is to build a new production line instead of its planned A5 fab (which was delayed/canceled in early 2018).

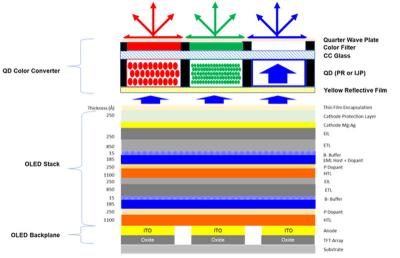

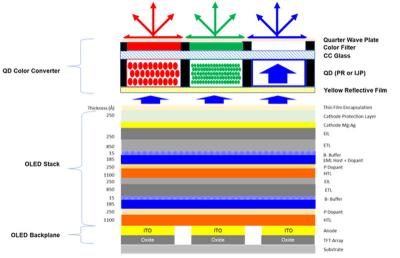

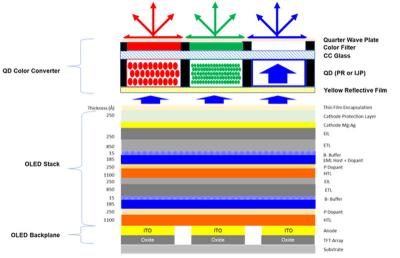

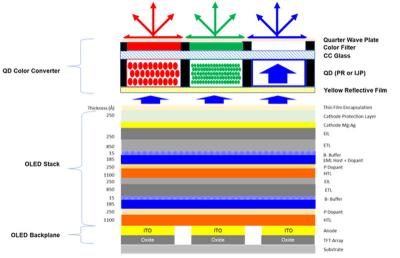

CSoT demonstrates a 6.6" QD-OLED display prototype

CSoT demonstrated the first public QD-OLED display, during SID 2019. The company unveiled a 6.6" display that features a relatively low resolution (384x300) and brightness (50 nits). The backplane of this prototype is an Oxide-TFT.

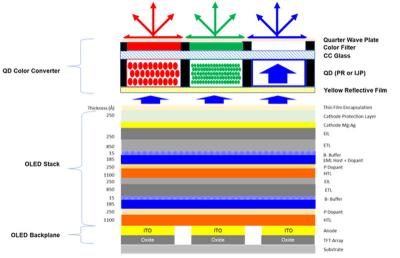

The QD-OLED is made from blue OLED emitters with a quantum-dots color conversion layer. This is a similar design to Samsung's QD-OLED TV technology. Interestingly earlier this year CSoT's parent company TCL has unveiled a different QD-OLED technology it refers to as H-QLED which uses a combination of OLED and QD emitters.

Reports from Korea suggest that Samsung still faces technology challenges before it can begin producing QD-OLED TVs

Samsung is developing its QD-OLED TV technology and the company was supposed to hold an investment review committee on April 2019 to decide whether to go ahead with plans to start production soon (mass production by the end of 2020).

However in May we later reported that Samsung decided to delay the production - trial production will begin towards the end of 2020, with real mass production on a new 10-Gen line only at around 2023. A new report from Korea sheds some more light on Samsung's situation.

New reports suggest that Samsung delays its QD-OLED TV production plans

In February 2019 it was reported that Samsung Display will hold an investment review committee on April 2019 to decide whether to go ahead with plans to start producing QD-OLED TV panels - and then commence mass production by the end of 2020.

According to a new report from China, Samsung will indeed go ahead with its QD-OLED production plans, but at a slower pace than was first estimated. Samsung will only begin trial production towards the end of 2020, with real mass production on a new 10-Gen line only at around 2023.

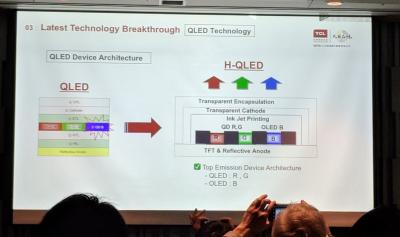

TCL is developing hybrid QD-OLED display technology

TCL unveiled that the company is developing a new hybrid display technology that uses a blue OLED emitter coupled with red and green QD emitters. All three emitter materials will be combined and printed using ink-jet printing technology. TCL calls this technology H-QLED and this could prove to be the technology of choice for TCL's future high-end emissive TV displays.

It seems as TCL believes that commercial-level red and green QD emitters will be achievable in the future, but blue QD emission will be more difficult to develop, and hence it will rely on OLED emitters. TCL did not disclose more details - but this R&D effort is being performed at the company's Juhua Printing platform.

Samsung Display to review its QD-OLED investment plan on April

According to reports, Samsung Display will hold an investment review committee on April 2019 to decide whether to go ahead with plans to start producing QD-OLED TV panels. If the plan is approved, Samsung will start installing production equipment towards the end of 2019, with mass production starting by the end of 2020 or early 2021.

According to earlier reports, Samsung aimed to start pilot production of QD-OLED TV panels in 2019. It's not clear whether the new reports suggest a delay or whether they only refer to the mass production step, with pilot production proceeding as planned.

DSCC: the production costs of a 55" QD OLED TV will reach almost $800 in 2019, will fall to $450 by 2022

DSCC says that production costs for a 55" QD-OLED TV panel at Samsung Display's 8.5-Gen fab will reach almost $800 in 2019. While this will fall to around $450 in 2022, Samsung will still lose money on every panel sold if DSCC has its price and cost estimates right.

It is important to note that most of the cost is depreciation costs - which means that in terms of cash on each panel, SDC's margins will actually be around 40%. Part of the reason for he high cost of required equipment is the need to use 12 TFT masks.. SDC is apparently looking to reduce the mask number which will lower production costs.

Pagination

- Previous page

- Page 10

- Next page