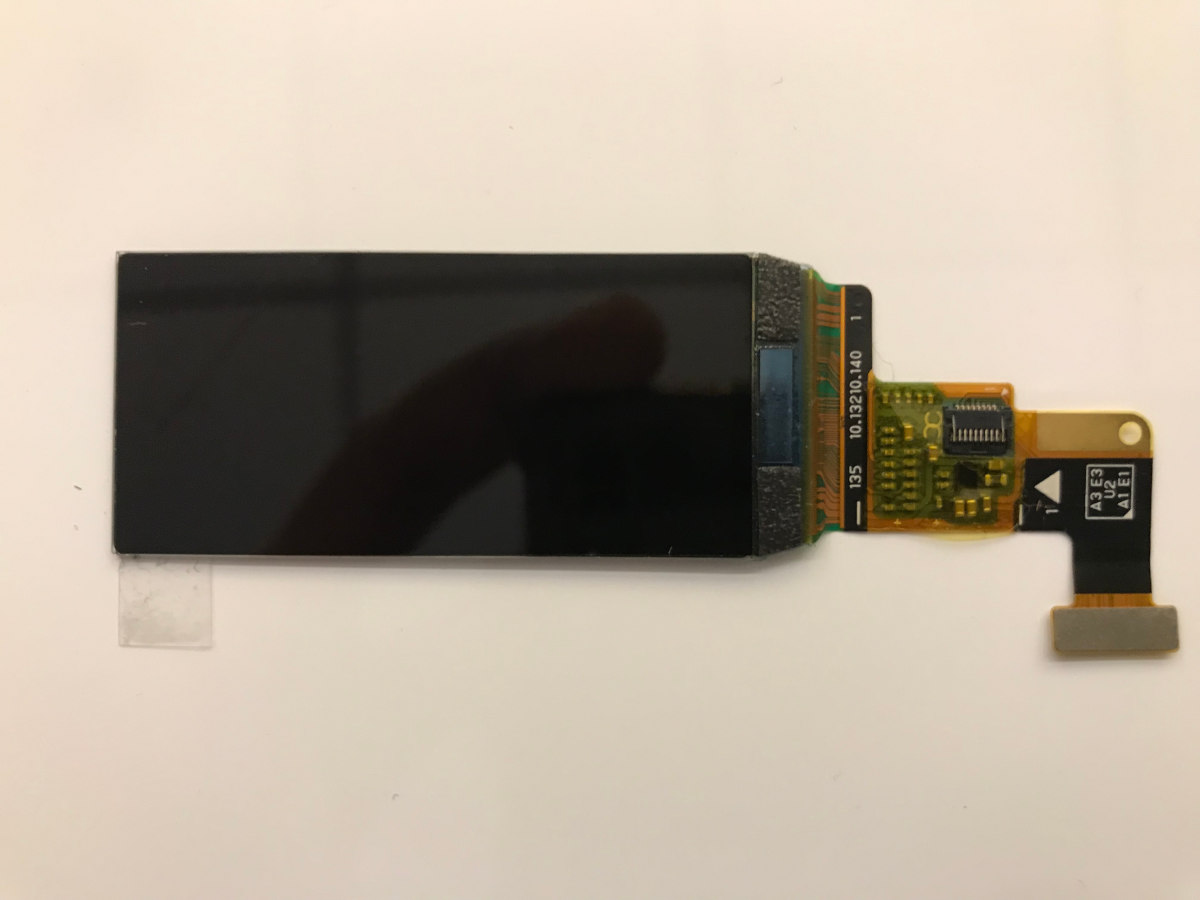

Everdisplay's 1.91" 240x536 AMOLED display is now available in the OLED marketplace

Many device makers have been seeking 2 to 4 inch AMOLED displays for a long time, as most display makers are focusing on either smartphone-sized displays or wearable ones. We have some good news on that front - China's Everdisplay has started to produce 1.91" 240x536 AMOLED displays, and these are now available in the OLED Marketplace.

These new small AMOLED displays can be great for many applications - if you are interested in this display for your device or new project, contact us now, or check out more information over at the OLED Marketplace.

Digitimes: SDC's 15.6" 4K OLED laptops displays cost $50-60 more than comparable LCDs

In February 2019 Samsung Display started production its new 15.6" UHD (3840x2160) OLED laptop display panels. SDC is targeting premium laptops, as these ultra high resolution panels are optimized for gaming, graphic design and video streaming.

Samsung already signed up a few customers - including HP with its Spectre x360, Lenovo with the Yoga C730 and Dell with the XPS 15, Dell G7 15 and the Alienware m15. According to a new report from Taiwan's Digitimes, Samsung is aggressively seeking new customers for its OLED laptop displays - and the company has pricing its 15.6" OLEDs at only $50-60 above comparable LCD displays.

DSCC details its estimation of smartphone OLED producers market share

DSCC released the interesting (but confusing, note the legend starts at 350M) chart below, detailing the market share of smartphone OLED producers in 2016-2019. As can be seen Samsung will remain the dominant producer, but its market share in 2019 will drop from 94% in 2018 to around 85%.

Non-SDC shipments will increase to 73 million units in 2019 - led by LG Display (~25 million units), BOE (around 20 million) and Visionox (around 15 million units).

Everdisplay's 6-Gen flexible OLED line in Shanghai is progressing, trial production to begin in January 2019

In 2016 China-based Everdisplay (EDO) started to construct a 6-Gen flexible AMOLED fab in Shanghai. In August 2017 EDO said that it finished the building's main steel frame roof, and in July 2018 EDO started to install equipment.

Everdisplay now announces that the new production line has been successfully lit for the first time. It's not exactly clear what the company means by that, but progress seems to be going well and EDO says that trial panel production will begin in January 2019, as planned.

CLSA lowers its china smartphone OLED production and adoption forecasts

CLSA says that as OLED displays are too expensive for many smartphone makers and lack enough differentiation to LCDs, the company is lowering its OLED adoption forecasts. CLSA now expects China's OLED smartphone shipments to total 116 million in 2018, 143 million in 2019 and 168 million in 2020. CLSA lowered its forecasts by 12-21%. In terms of penetration into the total Chinese smartphone market, CLSA sees 14% in 2018, 18% in 2019 and 21% in 2020.

Looking at the OLED makers, side, CLSA sees ample OLED supply in coming years, which means that expansion is likely to slow. CLSA assumed that OLED makers will achieve 70% yields and a utilization rate of 90%, which will bring all OLED makers to have a combined production capacity of around 288 million 6" panels in 2020. As demand will be only 168 million by Chinese phone makers (and remember there's also Samsung and LGD of course), this will create quite an oversupply situation in China. CLSA cuts its China OLED production forecasts by BOE, Tianma, Visionox, CSoT and Everdisplay by 23% to 26% in coming years.

Where are the 2 to 4 inch AMOLED displays?

All AMOLED makers are currently focused on two major markets - smartphone displays and wearable displays. This leaves out an important part of the market - displays that are between 1.5" and 5" in size, and device makers that want to adopt AMOLED displays in this size segment find it impossible to find the displays they want.

As smartphones grew larger and larger in recent years, the display makers are focusing on 5 to 6.5 inch for their smartphone display portfolio. Wearable AMOLED displays are exclusively aimed towards smartwatches - which use displays sized 1 to 1.5-inch, many of whom are round displays.

Everdisplay starts producing a 2.95" 1K 90Hz VR AMOLED display

China-based AMOLED producer Everdisplay has started to mass produce VR AMOLED displays. The company's first such panel is a 2.95" 1080x1200 (547 PPI) panel that features a refresh rate of 90Hz, a maximum brightness of 100 nits and a MIPI Interface.

This new panel is now available through the OLED Marketplace. Let us know if you are interested in acquiring this display and use it in your future device.

CINNO Research details the mobile AMOLED market share by producers

Market analysts from CINNO Research estimate that Samsung Display produced 160.9 million AMOLED displays in H1 2018, which sets SDC's market share in the mobile AMOLED market at 93%. The two other large producers are LG Display and Visionox, both producing 3.5 million panels (2% market share).

Both Everdisplay (EDO) and BOE produced 1.7 million panels in the first half of 2018 - or about 1% of the market each. AU Optronics and Tianma produced 0.7 million panels (0.4% market share) and Truly closes the list with a market share of 0.2% (400,000 panels).

IHS: LGD is the world's leading AMOLED producer for wearables, followed by SDC, EDO, AUO and BOE

IHS says that LG Display is the world's leading AMOLED supplier for smartwatches and wearables. In 2017 LGD shipped 10.64 million AMOLED displays for smartwatches - and it holds a market share of 41.4% (the total market was 25.7 million units in 2017). LG is the exclusive supplier of AMOLED displays for Apple's watch.

Samsung Displays is the 2nd wearable AMOLED Producer, with a 34.8% market share. Everdisplay has a 16.2% share and AU Optronics shipped 5.7% of all wearable AMOLED shipments in 2017. BOE is the fifth largest AMOLED wearable maker with a market share of 1.5%.

Everdisplay starts to install equipment at its 6-Gen flexible AMOLED line in Shanghai, announces its first flexible OLED panel

In 2016 China-based Everdisplay (EDO) started to construct a 6-Gen flexible AMOLED fab in Shanghai. In August 2017 EDO said that it finished the building's main steel frame roof, and yesterday EDO announced that it has finished constructing the building and the cleanrooms, and it has started to install the production equipment - a month earlier than it originally planned.

EDO's new fab will have a capacity of 30,000 monthly substrates (1500 x 1850 mm) and will be used to produce small and medium sized flexible AMOLEDs (1 to 15 inch). EDO aims to begin trial production in January 2019 and mass production in 2021.

Pagination

- Previous page

- Page 3

- Next page