EverDisplay Optronics (also known as Hehui Optoelectroics, and EDO), established in Shanghai, China in 2012, is an AMOLED display producer.

EverDisplay Optronics (also known as Hehui Optoelectroics, and EDO), established in Shanghai, China in 2012, is an AMOLED display producer.

Everdisplay started mass producing AMOLED displays towards the end of 2014 in a 4.5-Gen line with a monthly capacity of 20,000 substrates (EDO was China's first AMOLED maker). Since then the company added its second production fab, a 6-Gen flexible AMOLED line in Shanghai.

EDO is producing panels for wearables, smartphones, laptops, VR devices and more. Many of EDO's displays are available in the OLED marketplace.

In 2021, Everdisplay became a public company. We posted an interview with the company's marketing team in July 2014.

Jinshan Stadium

Jinshan District

Shanghai

China

UBI: OLED shipments increase in Q3 2024, mostly driven by increased shipments by LG Display and Everdisplay

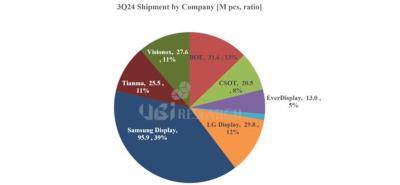

UBI Research says that shipments of small OLED panels rose to 247 million units, up 7.8% from the previous quarter (and up 32.6% from Q3 2023), mainly driven by increase in shipments by LG Display and Everdisplay.

LG Display shipped 17.6 million smartphones panels in the quarter, up 64% from Q2 and 12.2 million wearable OLED panels (up 147%) - thanks to strong shipments to Apple. In total LGD's AMOLED shipments grew 74% quarter to quarter, and 115% from last year. UBI expects LGD to continue and increase its shipments in Q4. The company is almost at full capacity and UBI says the company may decide to expand the capacity at one of its existing 6-Gen fabs.

Everdisplay to delay production at its new Shanghai 6-Gen OLED production line by one year

China-based AMOLED producer Everdisplay is constructing a new 6-Gen production line in Shanghai, an expansion of its existing fab. The company's original plan was to start mass production in December 2024, but it now announced it will delay this and mass production is now only expected in december 2025. This is the second delay of this project.

Everdisplay says that the reason for the delay is that the company wishes to upgrade the line to the latest OLED technologies, such as LTPO backplanes, Tandem stack architecture and a hybrid platform (which means rigid OLEDs with TFE encapsulation and a glass backplane).

Huawei expected to order 61 million smartphones OLED panels this year, up 81% from 2023

According to reports, Huawei is enjoying high demand for its AMOLED smartphones in 2024, and it is expected to order 61 million AMOLED panels by the end of the year - up 81% over 2023 (33.7 million).

Huawei suffered from US sanctions in 2019 that drastically decreased its smartphone sales, but in 2023 it has returned to the smartphone market in force, and now it is enjoying very high demand for its smartphones.

Lotus 2025 Eletre R electric SUV sports a 15.2" AMOLED display produced by Everdisplay

Lotus launched its 2025 Eletre R electric SUV, that has a 15.1" 2560x1600 750 nits AMOLED display, produced by Everdisplay (EDO). The display is the car's center multimedia display.

The Eletre R offers a 905hp electric engine, that can accelerate from 0-100Kmh in 2,95 seconds. The car has a range of 400-450 Km.

The US is looking into backlisting both BOE and Tianma as it fears that China is taking over the display industry, we look into the implications

The Chairman of the US House Select Committee on the Chinese Communist Party, John Moolenaar, sent a letter to the US Secretary of Defense, saying that the US should place both BOE and Tianna on the DoD 1260H blacklist as Chinese military companies.

In his letter, Mr. Moolenaar says that by using government support, the Chinese has taken over the display industry, and are already leading both the LCD and OLED markets (which is indeed mostly true). As these two companies have close ties to the Chinese government and military, this, according to the letter, poses a big risk to US and its allies.

BOE, Tianma, TCL CSoT, EDO and Visionox all post improved quarterly earnings

Recently, BOE, Tianma, TCL, EDO and Visionox all posted their financial results for Q2 2024, and all were rather positive. Samsung Display and LG Display also posted increased earnings for the quarter.

So we start with BOE, that posted revenues of 93.4 billion yuan (13.17 billion USD) for the first half of 2024, an increase of 16.47% over H1 2023. Its net profit increased 210% compared to last year (2.285 billion Yuan, or $320 million USD). BOE enjoyed increased LCD sales and optimized production, and also noted high demand for high-end foldable OLED displays.

Everdisplay starts installing equipment in its $825 million AMOLED module factory in Yangzhou

A few days ago, Everdisplay Optronics started to move-in equipment in its AMOLED module factory in Yangzhou High-tech Industrial Development Zone, in Jiangsu province.

Everdisplay estimates that the total investment in its new module factory will reach $825 million USD, and it will have an annual capacity of 70 million display modules - when its two lines are in operation. The construction of the factory started in December 2023.

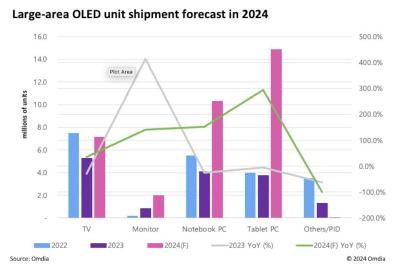

Omdia: shipments of OLEDs over 9-inch in size will soar 124% in 2024

According to Omdia, sales of OLED panels in sizes over 9-inch (the company refers to these as Large Area Displays) will increase 124.6% in 2024. In 2023, the market contracted 25.7%, with the only exception being OLED monitor panels that grew in shipments.

In 2024, Omdia says that all application areas will see an increase in shipments - TVs, monitors, tablets and laptops. Only the company's "other" category will see a decrease in sales. In particular, tablet OLED shipments are projected to increase by 294% compared to 2023, largely due to Apple's adoption of OLEDs in the 2024 iPad Pro tablets. Laptop OLED sales will increase 152.6%, and monitors OLEDs will increase 139.9%. Finally, OLED TV panel shipments will increase 34.8%.

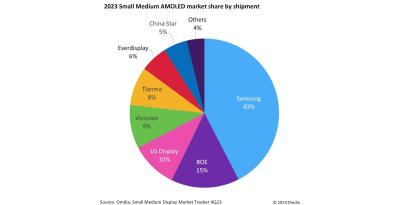

Omdia: Samsung leads the small and medium AMOLED market with a 43% market share in 2023

Omdia released its small and medium (9-inch and lower) AMOLED market share information for 2023, saying that even though Samsung's market share was lower than 50% for the first time, it stills leads the market by a large margin, with a 43% market share.

Samsung is followed by BOE (15%), LG Display (10%), Visionox (9%) and Tianma (8%). The total market reached 842 million units, a growth of 11% over 2022. Omdia says that the China-based OLED makers have been expanding their capacity and improving the quality of the produced panels, and are securing orders from domestic smartphone brands.

Everdisplay's losses increase as demand for OLED displays in sluggish

China-based AMOLED producer Everdisplay (EDO) reported its financial results for Q3 2023. Net loss increased to 1.1 billion Yuan ($150 million USD), and total loss in 2023 so far was 2.39 billion Yuan (around $325 million USD).

The company says that the increased loss and drop in revenues were due to the global economic recession and weak demand in the consumer electronics market. The industry is facing a fierce price competition with radical price drops by AMOLED makers causing revenues and losses to decline.

Pagination

- Page 1

- Next page