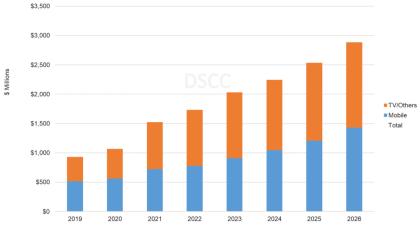

DSCC updated its OLED material market data, and it now sees AMOLED stack material revenues growing at a 18% from 2020 ($1.07 billion) to 2026 ($2.9 billion). If UDC actually manages to release a commercial blue PHOLED, the market could even exceed $3 billion.

The majority of OLED material revenues from from TV applications, but the market share of mobile devices is expected to grow and reach almost 50% by 2026.

DSCC looks at WOLED vs QD-OLED, and the company says that the cost of materials in a QD-OLED dipslay is lower than that of a WOLED, but it is a modest advantage. DSCC estimates that in 2022, the unyielded stack costs for QD-OLED are expected to be ~25% lower than the standard WOLED. But as yields of QD-OLED production are lower, and in addition there are other costs for QD-OLEDs, including a color converter (QD) that is more expensive than the color filters used in WOLED production.

DSCC also details a projection of material suppliers market share, as seen below (click on the image to enlarge it). The leading supplier is Universal Display, followed by DuPont, Novaled and Merck.These four companies together capture 56% of the revenues in 2022.