Counterpoint: OLED shipments grew 28% in Q3 2024, driven by higher demand for smartphones, TVs and laptops

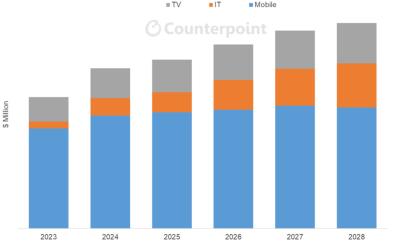

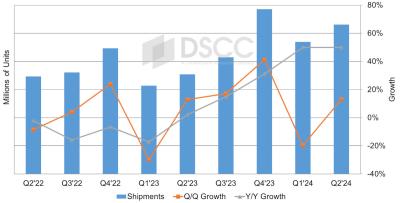

Counterpoint (DSCC) says that OLED panel revenues increased 28% in Q3 2024, and the company expects revenues in all of 2024 to grow 16% from 2023, mainly driven by growth in smartphones, TVs and IT applications.

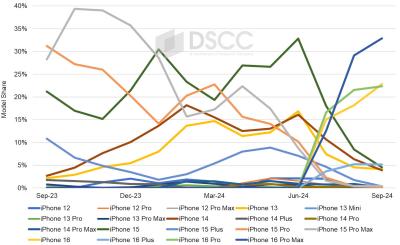

In terms of unit shipments, Q3 2024 saw a 34% increase from Q3 2023. Shipments of OLED smartphone panels increased 43% from 2023 (and 24% in revenues). OLED TV shipments grew 48% in the quarter (36% increase in revenue). The largest increase came from laptop OLED panels that more than doubled (108%) in shipments in Q3.