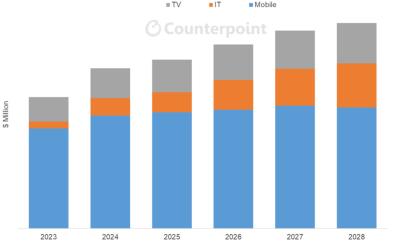

DSCC (now part of Counterpoint) says that OLED evaporation material sales will grow 22% in 2024, and will continue to grow at a 6.4% CAGR from 2024 to 2028. Most of the growth will come from IT display panels, for laptops, monitors and tablets.

Interestingly, DSCC estimates that Chinese material developers enjoyed a 58% increase in sales in 2024 to $252 million. The primary reasons for this sharp increase in demand is increased utilization at Chinese AMOLED fabs, increased orders from local companies in China over sourcing these materials from the rest of the world, and new range of materials introduced by materials makers (as Chinese material developers move from intermediates production to emitters and dopants).

DSCC says that BOE, for instance, has started sourcing green dopants and p-dopants from Summer Sprout, which were previously exclusively supplied by UDC and Novaled, respectively. This shift positions Summer Sprout alongside Jilin OLED and LTOM (Shaanxi Light Optoelectronics Materials) as the key China-based material producers.