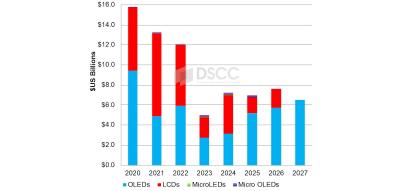

DSCC says that display makers are increasing their OLED CapEx investment as demand for OLED displays is on the rise. DSCC has raised its forecast for OLED spending by 14% compared to their previous update, while they retain their previous forecast for LCD, OLED microdisplay and microLED display equipment spending.

Between 2020 and 2027, OLED display makers will invest $44 billion in new production equipment. The spending on OLED equipment will keep growing year after year from 2023 to 2027, reaching $6.5 billion in 2027, as OLED penetration in the smartphone, tablet and laptop market is increasing, and fab utilization is increasing too, encouraging display makers to add capacity.

Looking at the geographic spread, China will be the dominant player, with 85% of all equipment spending between 2020 and 2027 done by Chinese display makers (led by BOE at 23%, TCL CSoT at 20%, Tianma at 11% and Visionox at 10%). Korea's share is expected to be 12% ($9 billion in total) - with Samsung at 7% and LGD at 5%. India will hold a 2% share, while Taiwan will hold only 1% share.

The leading equipment suppliers in DSCC's report period, 2020-2027, are Canon Tokki (with a 9.3% market share), Applied Materials (8.5%) and Nikon.

Looking at the application level, the main driver for growth is the IT market (laptops, monitors and tablets) with a 41% share of spending ($30 billion). Smartphones and wearables will have a market share of 30% ($22 billion) followed by TV/Other (28% share, $21 billion).