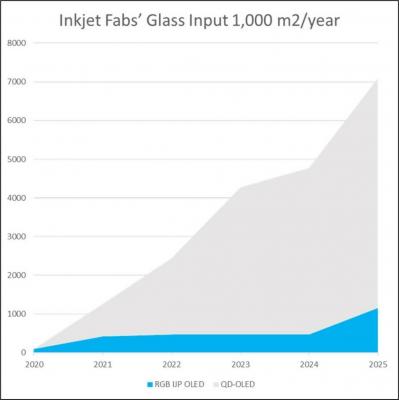

DSCC: Inkjet printing of emitters and color conversion layers for OLED displays to reach 7.1 million sqm by 2025

DSCC says that inkjet printing technologies for OLED display production is finally starting to gain traction, and the company sees IJP OLED display capacity to increase in a 137% CAGR from 2020 to 2025, to reach 7.1 million sqm.

As you can see from the chart, most of the growth will come from the printing of the quantum-dots color conversion layers in Samsung's QD-OLED fabs. Actual RGB inkjet printing will be confined to JOLED's fab which will start mass producing in 2021. In 2024, China Star (CSoT) will begin printing OLED TV panels at its T8 line.