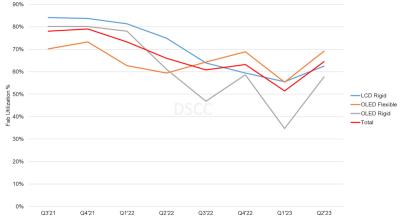

DSCC: the recovery in OLED fab utilization is slower than expected

According to DSCC, display fab utilization started to decline in Q2 2022, and this continued - and bottomed out towards the end of 2022. The industry is starting to recover, but the recovery is slower than expected before.

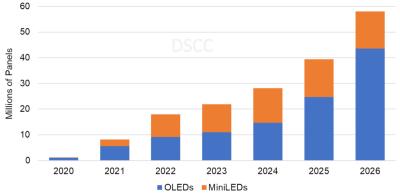

This is true for both LCD and OLED displays, as you can see in the graph above.