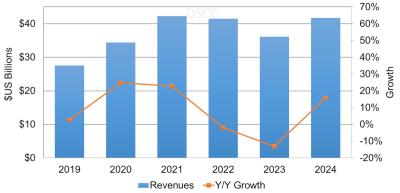

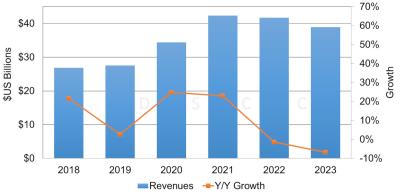

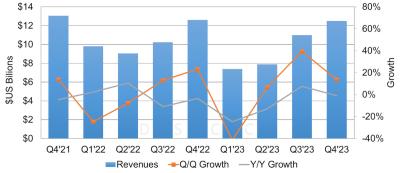

DSCC: the OLED market will decline 13% in 2023, growth to resume in 2024

DSCC estimates that OLED revenues in 2023 will be $36.1 billion - down 13% from last year. Just a few months ago DSCC's forecast for 2023 was $38.9 billion. This is the second year that the OLED market is contracting. In terms of shipments, there will be a 5% decrease in 2023. Looking forward to 2024, DSCC sees the market starting to recover, as demand for IT displays, TVs and smartphones will increase.

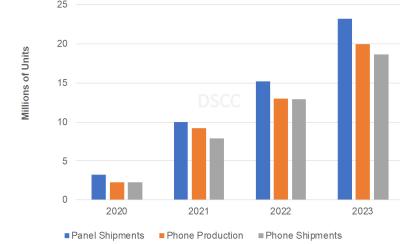

Looking at specific markets in 2023, DSCC says that OLED smartphone shipments will remain flat, but will drop 11% in revenues - as the demand for higher-end flexible displays is lower than in 2022. The only positive is the foldable display market, where shipments will increase 33% in 2023 compared to last year. 2023 also experiences a big drop in demand for OLED TVs - DSCC sees shipments declining 31% in 2023. The same goes for laptop OLEDs - a 32% decrease in sales in 2023.