OLED Smartphones - introduction and industry news - Page 9

DSCC says demand for smartphone and TV OLED displays will decline by 24% in the next quarter

DSCC says that OLED panel revenues were $12.6 billion in Q4 2022, down 3% from Q4 2021. Shipments declined by 7% compared to last year.

For the full year 2022, revenues reached $41.7 billion, a 1% decrease from 2021. AMOLED for smartphones shipments (units) decreased by 1%, while OLED TV panel shipments decreased by 9%. Some OLED segments grew in 2022 - AR/RV, automotive, monitors, and tablets.

Samsungs reports its Q4 2022 financial results, OLED sales declined as demand for smartphones fell

Samsung Electronics reported its financial results for Q4 2022, with revenues of $57.3 billion, and an operating profit of $3.5 billion.

Samsung says that the "business environment deteriorated significantly in the fourth quarter due to weak demand amid a global economic slowdown". SDC's mobile AMOLED panel business earning declined, as demand for smartphones fell, but its large-area panel business seen a smaller loss as it is increasing sales of QD-OLED panels.

Samsung asks the ITC to ban the import of aftermarket AMOLED smartphone displays into the US

According to reports, Samsung Display has appealed to the US ITC asking to ban aftermarket and refurbished AMOLED displays from entering the US.

Today it is possible to repair a smartphone display and replace the screen - and there are companies (mostly independent outlets) that offer lower cost displays - which could refurbished ones, aftermarket imports - or even lower cost alternatives produced by other makers. If the ITC approves Samsung's request, these will not be available anymore, and only original Samsung AMOLED displays will be allowed.

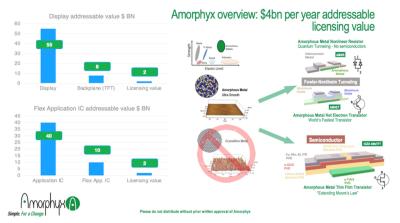

Amorphyx Q&A about champion performance in IGZO TFT for OLED Smartphone applications

This is a sponsored post by Amorphyx, where display industry consultant Ian Hendy has interviewed Amorphyx's CEO John Brewer

Q: Can you start by telling us a little about what Amorphyx does, John?

Amorphyx has several fundamentally new technology platforms that provide for TFT performance improvements in three areas: (1) Switching speeds, with options to move to the Tera-Hz range ultimately, (2) Power, where the IGZO AMeTFT can achieve even lower power performance than today’s LTPO OLED Pro Motion displays and better refresh range, and (3) Small transistor size.

Our technology platforms are lower cost than the alternatives, and move from amorphous and crystalline semiconductor approaches, to devices based on different effects that do not have a semiconductor at all, yet can still drive a display, drive current, deliver grey scale and switch very fast. Or they can operate a flex IC at higher clock speeds than known today.

For now, our main commercial focus is on IGZO AMeTFT which is fundamentally a potential replacement transistor for LTPS or LTPO used in modern OLED phones and has the capability to replace more highly compensated LTPO circuits in modern Smartphone displays due to enhanced stability.

Samsung shows a 2,000 nits smartphone AMOLED display, brands it as UDR

Samsung Display is showing a new OLED smartphone display, that achieves a brightness of 2,000 nits and an improved dynamic range. Samsung brands this as a UDR 2000 display.

The new OLED display was verified by UL (Underwriter Laboratories), an independent testing and validation firm, for the UDR 2000 certification. Samsung's AMOLED have already achieved 2,000 nits (for example in the iPhone 14 Pro screen), but this new display offers a higher dynamic range.

UBI sees sales of rigid OLED panels to continue and decline, while flexible and foldable OLEDs are on the rise

UBI Research says that according to its latest information and forecasts, shipments of Samsung's rigid smartphone AMOLED displays declined to 19 million units in Q3 2022, a drop of over 50% compared to last year. Rigid smartphone OLED display sales will continue to decline at an annual rate of 12.9% and will reach only only 96 million units in 2027.

Flexible OLED sales will continue to increase at a rate of 7.4% from 2022 to 2027. In 2027, Samsung Display will ship 220 million flexible OLED displays, while BOE will ship 140 million OLEDs.

All in One sensing for OLED 2.0 and leadership role of ISORG

The following is a sponsored post by ISORG

ISORG is a French company based in Grenoble and Limoges in France, and the world centre of excellence for OPD technology (Organic Photo Diode). With more than 85 patents, ISORG is a technology rich company focused on three main market opportunities: (i) Smartphone fingerprint sensing, (ii) Security applications such as identification and border-crossing markets and (iii) SWIR and NIR CMOS imaging markets for automotive, AR-VR and smartphone applications. It has Gen 2 and Gen 3.5 factory capacity in France and a set of partnerships with leading companies in sensing and authentication. More can be found on ISORG here. In May 2022, CEO Dieter May left the helm of OSRAM Opto Semiconductors to join ISORG.

Display industry consultant Ian Hendy has interviewed ISORG's CEO Dieter May.

Visionox signs an agreement with the government of Hefei to build its $1.6 billion flexible OLED module fab

In May 2022, Visionox announced plans to build a 11 billion Yuan ($1.6 billion USD) flexible and foldable OLED module production line, in Hefei. Yesterday the company signed the formal agreement with the local government and kickstarted the project.

According to reports from China, the new factory will have a yearly capacity of around 26 million modules in sizes ranging from 6-inch to 12-inch, although the company says it will also produce wearable OLED display modules at this fab, so there will be smaller sizes as well.

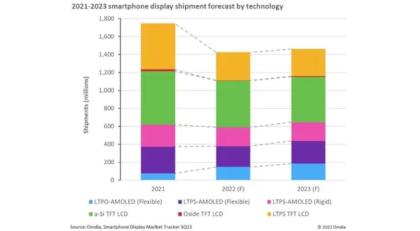

Omdia: the smartphone market is shrinking, but the LTPO-AMOLED display segment is growing fast

Market research firm Omdia says that the global smartphone market is shrinking, and is set to fall 18% in 2022 to 1.425 billion units. LTPS AMOLED display shipments will decline 19% compared to 2021 to 44 million units (LCDs will decline even faster at 26%).

The only segmented that Omdia says is growing is the LTPO AMOLED one, with a fast growth of 94% in 2022 (to 148 million units), and will continue to grow in 2023 (25%).

LG Display starts to ship LTPO AMOLED displays to Apple

According to ETNews, Apple approved LG Display's LTPO AMOLED displays for the iPhone 14 Pro, and so LGD starts to ship displays to Apple - what has been an exclusive supply by Samsung Display.

The iPhone 14 Pro has a 6.1" 120Hz 2000 nits 1179x2556 LTPO AMOLED display, while the 14 Pro Max has a larger 6.7-inch 1290x2796 panel.

Pagination

- Previous page

- Page 9

- Next page