OLED Smartphones - introduction and industry news - Page 8

DSCC: BOE's market share in flexible smartphone OLED displays rose to 27%

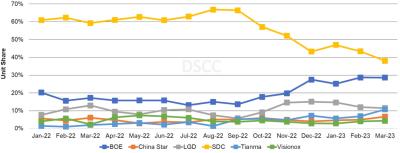

DSCC says that BOE's market share in the flexible (and foldable) smartphone OLED market has risen to 27% in Q1 2023. BOE flexible and foldable OLED panel sales grew 81% in Q1 2023 compared to last year, as the company enjoys growing sales to Apple, Huawei, Oppo, Realme, Vivo and ZTE. BOE is mostly taking market share from Samsung and LG, while Tianma's market share is also on the rise.

DSCC estimates that flagship smartphone shipments grew 17% in the first quarter, with flexible OLED smartphone shipments growing 18% and foldable ones growing 4%.

Sigmaintell: production of OLED smartphone displays in China to jump 40% in 2023

Most analysts seem to agree that global demand for OLED displays is set to slow down in 2023. DSCC says that revenues will decrease 7% in 2023, led by a drop in demand for OLED smartphone and TV displays. Omdia also agrees, saying that OLED fab utilization remains low.

China-based Sigmaintaell, meanwhile, is optimistic on China's own OLED industry, expecting production to jump 40% in 2023. Sigmaintell says that Chinese phone makers are increasing their adoption of OLED displays in high-end and mid-range models. The company's analysts expect over 220 million Chinese OLED panels to ship in 2023, and China's OLED market share to rise to 38%, up from 28% in 2021.

Omdia: OLED fab utilization remains low at 60% as the OLED industry hasn't yet recovered from the oversupply in 2022

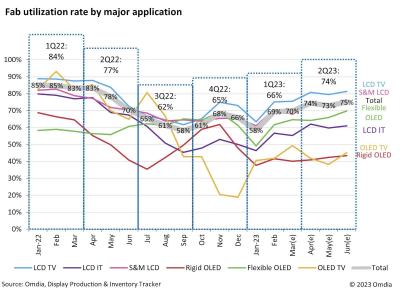

Omdia says that the utilization at display production fabs is on the rise, recovering from 66% in January 2023 to 74% in the second quarter, as demand for TVs, laptops, monitors and smartphones is on the rise.

However, this is mostly true for LCD displays. OLED producers are still facing low demand, and fab utilization remains below 60%. The industry has yet to recover from the oversupply it experienced in 2022. This is true for both mobile AMOLED displays and OLED TV panels.

Samsung to use its current M12 stack for the iPhone 15 series

According to a new report by The Elec, Samsung displays for Apple's upcoming iPhone 15 phone series will use the same material stack (M12) that were used in the iPhone 14. The M12 was used in the upper-range iPhones 14 series, but this year in the iPhone 15 series, all four models will use the same material stack.

The Elec also says that Samsung's next foldable phones will also use the same M12 stack, used in the previous generation foldables (Galaxy Z Fold 4 and Galaxy Z Flip 4).

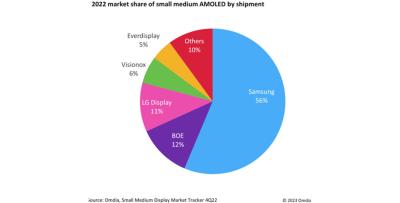

Omdia: small-size AMOLED display shipments down 6% in 2022

Omdia says that small-size (under 9") AMOLED display shipments dropped 6% in 2022 to 762 million units, due to lower demand for smartphones.

Samsung remains the leading AMOLED maker, with a 56% market share (by unit), down from 61% in 2021, with BOE in the second plane (12%) and LG Display in the third place (11%). The next producers by shipments are Visionox and Everdisplay.

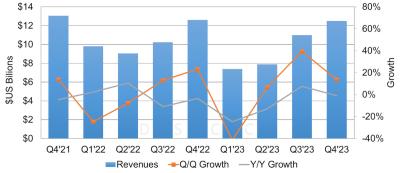

DSCC: OLED revenues to decline 7% in 2023, due to low demand for TV and smartphone panels

DSCC estimates that the OLED market will contract 7% in 2023, by revenues, to reach $38.7 billion. In terms of shipments, there will be a 1% decline from last year.

The two main OLED markets, smartphones and TVs, will both decline - OLED smartphone revenues will decline by 8% in 2023 (shipments will remain the same), while OLED TV panel revenues will drop 15% (12% by shipments).

Samsung launches a website that tells you whether your smartphone has an OLED made by SDC

Samsung Display launched a new web site, called OLED Finder, in which you can choose your phone model to see whether it uses an OLED produced by Samsung Display.

This is a marketing play by SDC, that aims to establish the superiority of Samsung's own OLED panels, over competing panels made by LGD, BOE, Visionox, etc. The website does not include all phones though that use OLED displays - for example it does not include any of Apple's iPhones.

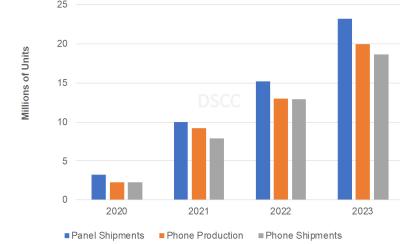

DSSC sees the foldable OLED smartphone market growing 45% in 2023, with over 35 new models

DSSC says that more smartphone makers will join the foldable phone market in 2023, with 37 new models introduced (up from 19 in 2022) - including new models from Google and OnePlus. DSSC says at least 16 new clamshell phones will be released, at least 20 in-folding type and one new out-folding device.

Looking at foldable smartphone shipments, DSSC says that the market will grow 45% to reach 18.6 million units, as performance increases and price decreases.

Reports from Korea suggest that BOE is facing technical challenges as it struggles to become an OLED supplier for Apple's iPhone 15

According to reports from Korea, BOE is developing smartphone OLED displays for Apple's iPhone 15 range, but it is facing technical hurdles.

Specifically, the iPhone 15 design has a camera (and FaceID sensors) punch-hole inside the OLED, and BOE's panel suffer from light leakage from the OLED into the camera hole area.

DSSC says foldable smartphone shipments dropped in Q4 2022 for the first time, but growth will return in Q2 2023

DSSC says that 3.1 million foldable smartphone shipped in Q4 2022, a drop of 48% compared to the previous quarter (and 26% compared to Q4 2021). This is the first time that the foldable smartphone market contracted.

DSSC says that the market was "overwhelmed by the launch of the iPhone 14 Series". Worsening global economic conditions also reduced demand. In the full year 2022, 12.9 million foldable phone shipped (a 62% increase over 2021), led by Samsung with a 83% market share.

Pagination

- Previous page

- Page 8

- Next page