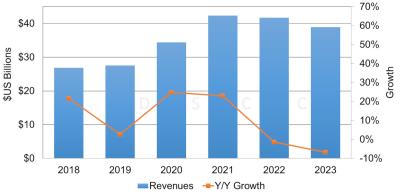

DSCC: OLED panel revenues to decline in 2023, in a second consecutive year

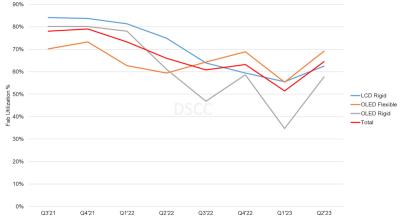

DSCC says that OLED panel revenues will decline 7% in 2023 (to $38.9 billion), the second consecutive year that the OLED market is seeing a decline in sales. The largest declines will be in the OLED TVs and laptops segments.

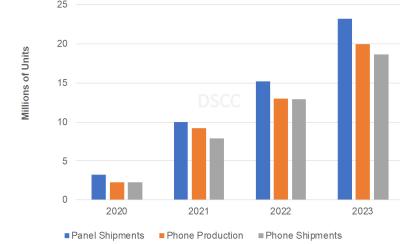

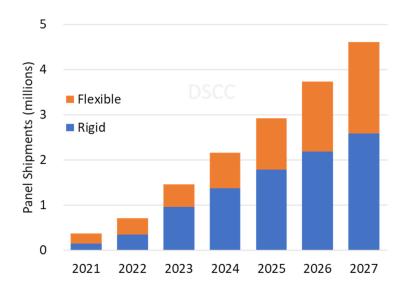

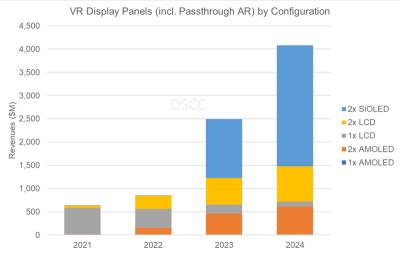

The OLED smartphone market will actually grow 4% in unit sales, but revenues will decline 5%. The OLED TV market will decline 29% in 2023 in both revenues and units. OLED laptop unit sales will decline by 15%. All other segments, including AR/VR, automotive and tablets, will grow in sales and revenues in 2023.