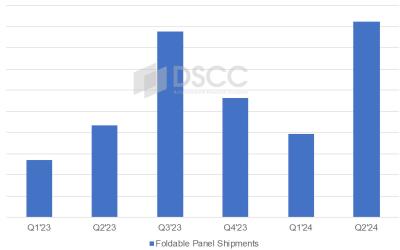

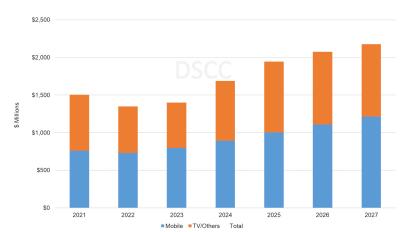

DSCC sees 9.25 million foldable OLED panels shipped in Q2 2024, with Samsung returning to a dominant position

DSCC says that foldable OLED shipments increased 46% in the first quarter of 2024 compared to last year, to reach almost 4 million units.

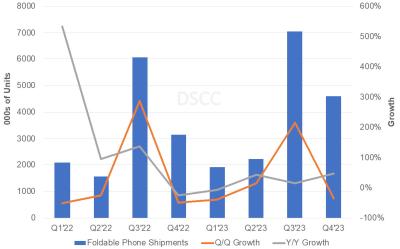

BOE was leading the market in Q1 2024, with a market share of 48% (up from 43% in Q1 2023). The two leading foldable smartphone models were Huawei's Mate X5 and Pocket 2, using panels supplied by BOE. In fact Huawei had a market share of 55% in the foldable smartphone market.