Will Samsung decide to abandon its QD-OLED technology?

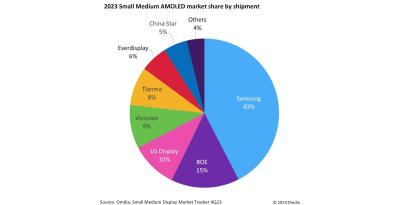

In 2019 Samsung Display announced its decision to invest $10.85 billion in QD-OLED TV R&D and production lines. A few years later, SDC started to produce panels in its first fab, mass producing TV and monitor QD-OLEDs. The company attracted several customers (Sony and Samsung Electronics for TV panels, and several companies for its monitors), and these displays have been very well received by the market.

Since 2022, Samsung has increased its production yields, and increased its production capacity, and today it produces around 40,000 substrates a month in its 8.5-Gen production line. Reviews of QD-OLED gaming monitors and TVs are very positive, with many analysts seeing QD-OLED as improving over LGD's WOLED panels in terms of image quality.

But the reality at Samsung Display's QD-OLED division, is likely not so rosy. It seems that the technology is facing both market challenges and technology challenges - which may lead to a decision by Samsung to abandon it altogether.