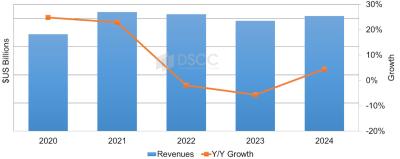

IDC: Samsung leads the OLED monitor market, with a 34.7% market share

Samsung Electronics started selling OLED monitors in 2023, and one year later, according to IDC, it leads the global OLED monitor market, with a 34.7% market share by revenues. It also is the leader in shipments with a share of 28.3%.

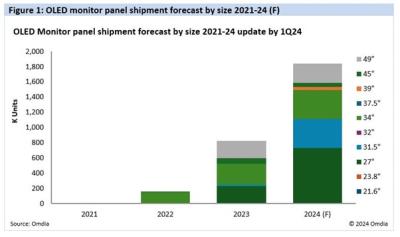

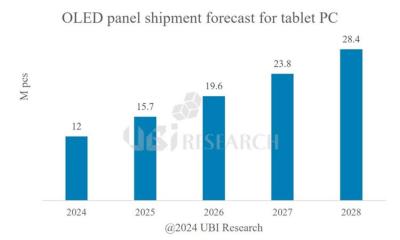

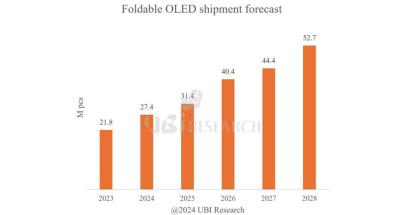

Samsung's first monitor was the 34" OLED G8, a QD-OLED gaming monitor. Since then Samsung released several new OLED monitors, and it's likely that the OLED Monitor market is set for fast growth ahead.