DSCC: miniLED IT panels are more expensive to produce than tandem OLED panels

DSCC posted an interesting article, comparing the production costs of OLED vs mini-LED panels for IT. DSCC estimates that for tablets and notebooks, a tandem structure will be used, and the panels will be based on rigid substrates.

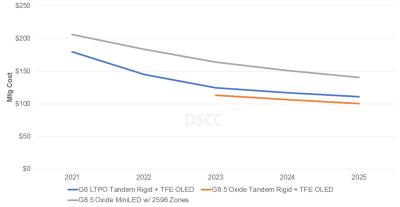

In the chart above you see a production cost comparison, between 2021 and 2025, for 12.9" panels. DSCC looks at two OLED production options: a tandem OLED panel with an LTPO backplane produced in a 6-Gen fab, and a similar panel that uses an Oxide-TFT backplane and produced in a larger 8.5-Gen fab. As you can see, OLED panels are more cost effective, and will remain so throughout the forecast period.