OLED Smartphones - introduction and industry news - Page 3

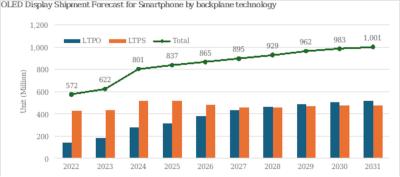

Omdia: in 2028, LTPO will overtake LTPS as the OLED backplane of choice for smartphones, by 2031 520 million LTPO smartphones will ship

Omdia says that in 2028, LTPO will overtake LTPS as the leading smartphone OLED backplane technology. By 2031, smartphone LTPO OLED panel shipments will reach 520 million units, with a 52% market share (of all smartphone OLED displays).

Omdia sees the smartphone OLED market rising in the next 10 years. In 2031, over one billion OLED smartphone panels will ship. In 2024, Omdia sees a sharp increase of 24% in smartphone OLED shipments (compared to 2023), which will surpass 800 million units.

Samsung Display reports increased demand for mobile AMOLEDs and gaming monitors in Q2 2024

Samsung Display posted its financial results for Q2 2024, with $5.5 billion in sales and $730 million in operating profit. The company says that its mobile AMOLED unit have seen sales growth, driven by solid demand for flagship products, along with effectively supporting new smartphone launches from key customers (i.e. mostly Apple).

Reports suggest LGD was selected as Apple's second AMOLED supplier for the upcoming iPhone SE4

Earlier this year we reported that Apple has decided to sign up BOE as its AMOLED supplier for the upcoming budget iPhone SE4 (with a 6.1" AMOLED display). According to reports back then, Apple's low price target ($25) was not profitable for Samsung that decided to not supply any AMOLEDs for this iPhone model.

According to new reports from Korea, Apple now signed up LG Display to supply some of its iPhone SE4 panels - mostly backup (BOE had its issues with Apple before) and support, as BOE will remain the main panels supplier.

Xiaomi announced four new AMOLED devices, including two new foldable smartphones

Xiaomi announced four new devices, all with high-end AMOLED displays. First up we have the Mix Fold 4, a foldable smartphone that has a 7.98" 120Hz 3000 nits 2224x2488 foldable LTPO AMOLED display, and a second 6.56" 120Hz 3000 nits 1080x2520 LTPO external AMOLED display.

Xiaomi's Mix Flip is a clamshell smartphone that offers a 6.86" 120Hz 3000 nits 1224x2912 foldable LTPO AMOLED, with a secondary 4" 120Hz 3000 nits 1392x1204 AMOLED display.

Samsung announces the Z Flip6 and Z Fold6 foldable smartphones, and two new OLED wearables

Samsung announced today four new devices - two foldable smartphones, and two smartwatches, all with AMOLED displays. All of these devices will ship on July 24.

First we have the latest clamshell smartphone, the Galaxy Z Flip6 - that has a foldable 6.7" 120Hz 2,600 nits 1080x2640 LTPO AMOLED display. It also has a 3.4" 720x748 Super AMOLED cover display.

DSCC: demand for AMOLEDs to increase, but the market will remain in oversupply

DSCC says that the AMOLED industry (mainly smartphones and IT applications) is still in oversupply, and this will remain so until 2028 - but demand is expected to increase faster than capacity and so the oversupply will gradually decline to 2028.

Regarding OLED TVs, demand will increase and fab utilization will improve - but in this market DSCC also sees an oversupply situation to 2028 at least (a surplus of 22% in 2028).

ETNews: Samsung Display to supply its latest M14 AMOLED panels to Apple and Google

ETNews reports that Samsung Display has developed a new OLED stack, the M14 stack, that it will sell to both Apple and Google to be used in their latest smartphones. The new stack improve the efficiency, lifetime and brightness of the display compared to SDC's previous generation stack.

According to ETNews, the new M14 stack will be used int he upcoming iPhone 16 Pro and Pro Max. Apple's regular iPhone 16 models will use the previous AMOLED stack, Samsung's M12. Google will also adopt the M14 stack in its Pixel 9 (all 3 model types) and the upcoming Pixel Fold 2.

Is LG Display leading over Samsung Display with the quality and performance of its latest OLED?

Since Samsung started mass producing AMOLED displays in 2007, most people believe that the company is not only the leader in OLED production capacity, but also in the performance of its displays. In most cases, Samsung has been the first company to develop and manage to mass produce the most advanced OLED displays, and the first to adopt the latest OLED materials, architectures, and processes.

There are some signs that this could be changing, although honestly it's a bit too early to know. In May 2024, Apple launched its first OLED Tablets, and according to reports, Apple chose LG Display as its main supplier, ordering around 60% of its iPad OLEDs from LGD (with all of the 13" model orders going to LG), and the rest from Samsung. Later it was reported that Apple had to delay the introduction of its 2024 iPad Pro devices as Samsung faced low production yields and could not deliver displays in time.

DSCC sees OLED market revenues growing 12% in 2024 helped by Apple's first OLED tablets

DSCC says OLED revenues are expected to grow 12% in 2024 and reach $44 billion. OLED panel shipments will grow 18% in 2024. The fastest growing OLED market segments are tablets and monitors.

OLED tablet panel shipments will increase 202% in 2024, and this will result in a 632% increase in revenues, driven mostly by Appe's first adoption of OLED panels in its 13" and 11.1" iPad Pro tablets. OLED monitors will grow slower, but still impressively - 80% in shipments, and 45% in revenues.

Omdia: OLED overtakes LCD and is now the market leading smartphone display technology

Omdia estimates that in 2024, OLED technology has finally overtaken LCD and now holds a market share of 53% in the smartphone display market. OLED penetration is expected to increase to 56% in Q3 2024.

Omdia further says that smartphone shipments have increased 5% in 2023 to reach 1.45 billion units, and the market will continue rising in 2024.

Pagination

- Previous page

- Page 3

- Next page